The cryptocurrency market is trading lower today, with total market capitalization down 2.6% to $3.46 trillion, according to data from CoinMarketCap. However, 24-hour trading volume rose to $292 billion, signaling steady market participation despite the pullback.

TLDR:

- Global crypto market cap fell 2.6% to $3.46T;

- BTC -2.5% ($101,674), ETH -6.0% ($3,299), SOL -3.0% ($156);

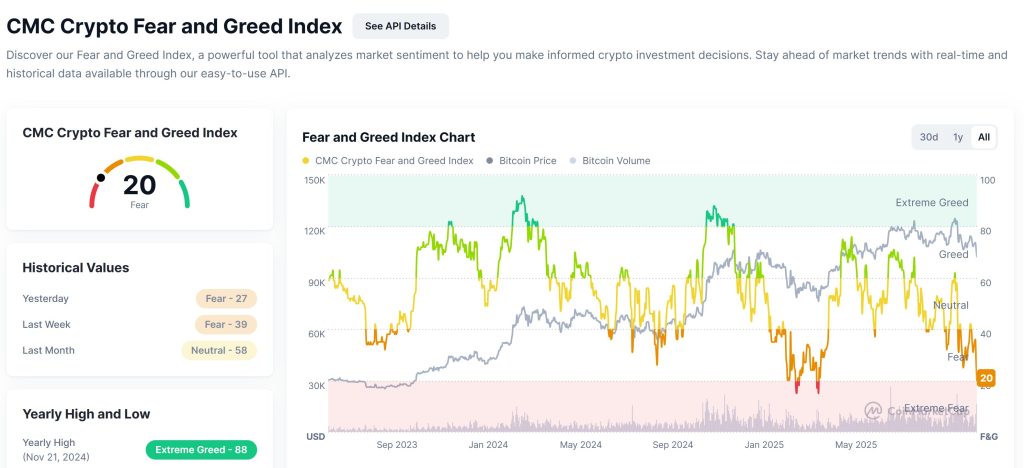

- Fear & Greed Index dropped to 20 (Fear) from 27 yesterday;

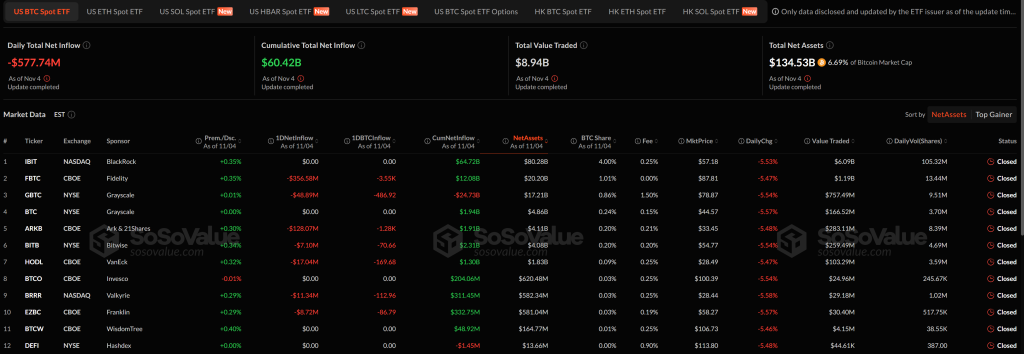

- BTC ETFs saw $577.7M outflows;

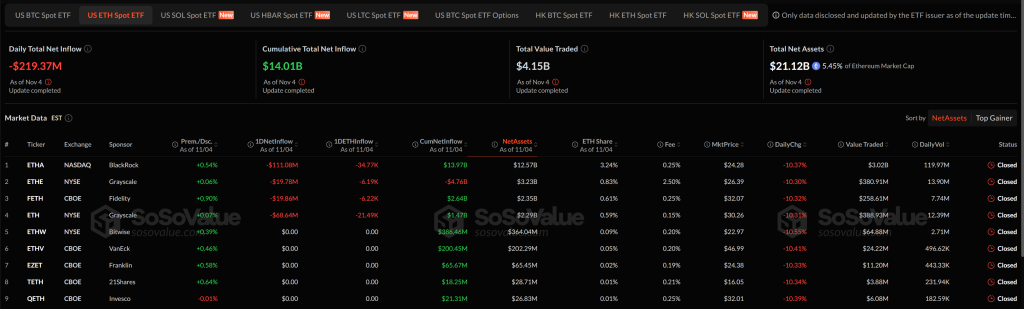

- ETH ETFs recorded $219.4M outflows;

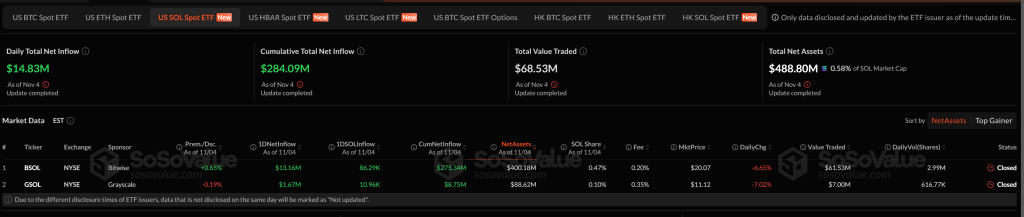

- SOL ETFs bucked the trend, gaining $14.8M inflows;

- Metaplanet drew $100M from its $500M Bitcoin-backed facility to fund BTC buys and share buybacks;

- Bitcoin briefly dipped below $100K amid the U.S. government shutdown, Fed uncertainty;

- Zohran Mamdani elected NYC mayor, with Polymarket traders correctly predicting the outcome.

Crypto Winners & Losers

At the time of writing, most of the top cryptocurrencies are in the red over the past 24 hours.

Bitcoin (BTC) fell 2.5% to $101,674, maintaining a $2.02 trillion market cap.

Ethereum (ETH) dropped 6.0% to $3,299, while BNB (BNB) slipped 1.3% to $943.

XRP (XRP) tumbled 1.9% to $2.23, and Solana (SOL) declined 3.0% to $156, extending last week’s losses.

Dogecoin (DOGE) edged down 1.6% to $0.163, and Cardano (ADA) shed 2.5%, now at $0.531.

Despite the market-wide decline, a few tokens stood out.

Momentum (MOM) led the gains, surging 242.4%, followed by DeAgentAI (DAI) up 65.5%, and Anvil (ANV) rising 53.1%.

Trending tokens on CoinMarketCap included Intuition (ITU), Momentum (MOM), and Firo (FIRO), signaling trader interest in AI and privacy-related projects amid volatility.

Meanwhile, Tokyo-listed Metaplanet executed a $100 million Bitcoin-backed borrowing on October 31, drawing from a $500 million credit facility established days earlier to fund additional crypto acquisitions, expand its options trading business, and potentially repurchase shares.

The conservative borrowing represents just 3% of Metaplanet’s $3.5 billion Bitcoin reserve, maintaining substantial collateral buffers even during potential market crashes.

Bitcoin Drops Below $100K as US Shutdown, Fed Uncertainty Weigh on Markets

Bitcoin fell to a five-month low below $100,000 on Wednesday as traders reacted to the prolonged U.S. government shutdown and renewed concerns over slowing economic growth.

Ether led the decline, tumbling over 12% to $3,179, while total crypto liquidations topped $2.09 billion in 24 hours, mostly from long positions.

Analysts said the drop was driven less by leveraged futures and more by spot investors stepping aside amid waning confidence after Fed Chair Jerome Powell signaled that a December rate cut isn’t guaranteed.

The broader crypto market slipped alongside global equities, with total market capitalization down 4.8% to $3.45 trillion and Bitcoin dominance rising above 60%, reflecting investors’ flight to relative safety.

Analysts warned that altcoins could fall another 30% versus Bitcoin as liquidity thins and speculative appetite fades.

Meanwhile, US stock indexes, including the S&P 500 and Nasdaq, posted their biggest single-day drops since early October, led by weakness in tech and renewed warnings from top banks about bubble risks tied to the AI boom.

Macro pressures deepened as the U.S. government shutdown stretched to 36 days, freezing key economic data and leaving investors reliant on private indicators for guidance.

Combined with Trump’s renewed trade threats against China and doubts about future Fed rate cuts, risk sentiment soured across global markets.

Still, analysts like Ryan Lee of Bitget said Bitcoin could rebound toward $115,000–$120,000 if macro conditions stabilize, though geopolitical risks and inflation remain key downside threats.

Levels & Events to Watch Next

At the time of writing, Bitcoin is trading around $101,992, up 0.52% on the day after briefly dipping below the key $100,000 mark earlier in the week.

The asset is attempting to stabilize near the lower boundary of its recent range, with sentiment still fragile following a sharp sell-off.

BTC is currently oscillating between $101,000 and $104,000, suggesting short-term consolidation after heavy liquidations.

A break above $104,500 could open the path for recovery toward $107,000 and $110,000, while failure to hold the $101,000 level may expose the market to further downside toward $98,500–$97,000, a zone closely watched by traders for potential rebounds.

Meanwhile, Ethereum trades near $3,319, up 1.02% on the day, recovering slightly after Monday’s steep decline that sent prices to their lowest level since July.

ETH faces immediate resistance near $3,400–$3,500, where selling pressure remains strong. A sustained push above $3,550 could signal a short-term reversal toward $3,750–$3,900, while a drop below $3,250 risks triggering a deeper correction toward the $3,000–$2,950 region.

Meanwhile, market sentiment has deteriorated further, with the Crypto Fear and Greed Index plunging to 20, signaling deep “Fear.”

The index stood at 27 yesterday, 39 last week, and 58 a month ago, showing a steady slide from neutral territory into fear as the broader market sell-off accelerates. The current reading marks one of the lowest sentiment levels since early 2024, highlighting how investors have shifted from optimism to caution.

Spot Bitcoin exchange-traded funds (ETFs) saw significant outflows of $577.7 million on November 4, indicating intensified selling pressure across institutional Bitcoin products, according to data from SoSoValue.

The cumulative total net inflow for all US spot Bitcoin ETFs now stands at $60.42 billion, while total net assets amount to $134.53 billion, representing 6.69% of Bitcoin’s market capitalization. Total daily trading volume reached $8.94 billion, showing active institutional participation despite bearish market sentiment.

Among individual issuers, Fidelity’s FBTC led the outflows with $356.6 million, followed by Grayscale’s GBTC at $48.9 million and Ark & 21Shares’ ARKB with $128.1 million. BlackRock’s IBIT reported no inflows or outflows for the day but remains the sector leader with $80.2 billion in net assets, followed by Fidelity’s $20.2 billion and Grayscale’s $17.2 billion.

Spot Ethereum ETFs also recorded $219.37 million in outflows on the day. Among the nine listed funds, BlackRock’s ETHA led redemptions with $111.08 million in outflows, followed by Grayscale’s ETHE at $19.78 million, Fidelity’s FETH at $19.86 million, and Grayscale’s ETH with $68.64 million.

The total cumulative net inflow for US spot Ethereum ETFs now stands at $14.01 billion, while total net assets fell to $21.12 billion, representing 5.45% of Ethereum’s market capitalization. Daily trading volume reached $4.15 billion, underscoring elevated turnover even as institutional sentiment cooled.

Spot Solana ETFs continued to attract investor interest, recording $14.83 million in net inflows on November 4. Among the two listed products, Bitwise’s BSOL dominated with $13.16 million in inflows, while Grayscale’s GSOL added $1.67 million.

The total cumulative net inflow now stands at $284.09 million, while total net assets reached $488.80 million, accounting for 0.58% of Solana’s market capitalization. Total daily trading volume came in at $68.53 million, reflecting steady engagement despite broader market weakness.

Meanwhile, Zohran Mamdani has been elected as New York City’s next mayor, marking a historic moment for the city and a notable win for crypto prediction markets that once again called the outcome with striking accuracy.

Data from Polymarket, the blockchain-based prediction platform, showed that 92% of traders bet on a Mamdani victory before election day, including a $1 million position that pushed implied odds close to certainty.

The post Why Is Crypto Down Today? – November 5, 2025 appeared first on Cryptonews.

Metaplanet secures $100M Bitcoin-backed loan to buy more BTC, expand options trading, and support share repurchase program.

Metaplanet secures $100M Bitcoin-backed loan to buy more BTC, expand options trading, and support share repurchase program.