In this technical blog, we will look at the IONQ recent price action. The company deals in quantum computing, specializes in developing and manufacturing quantum computers. The stock made a rally higher as highlighted in last September 2025 update here. Rally higher took place took place in another 5 waves structure and made a pullback, which ends up entering into previous wave I territory. Thus suggested that it’s no longer wave (III) taking place. We will explain the latest forecast below:

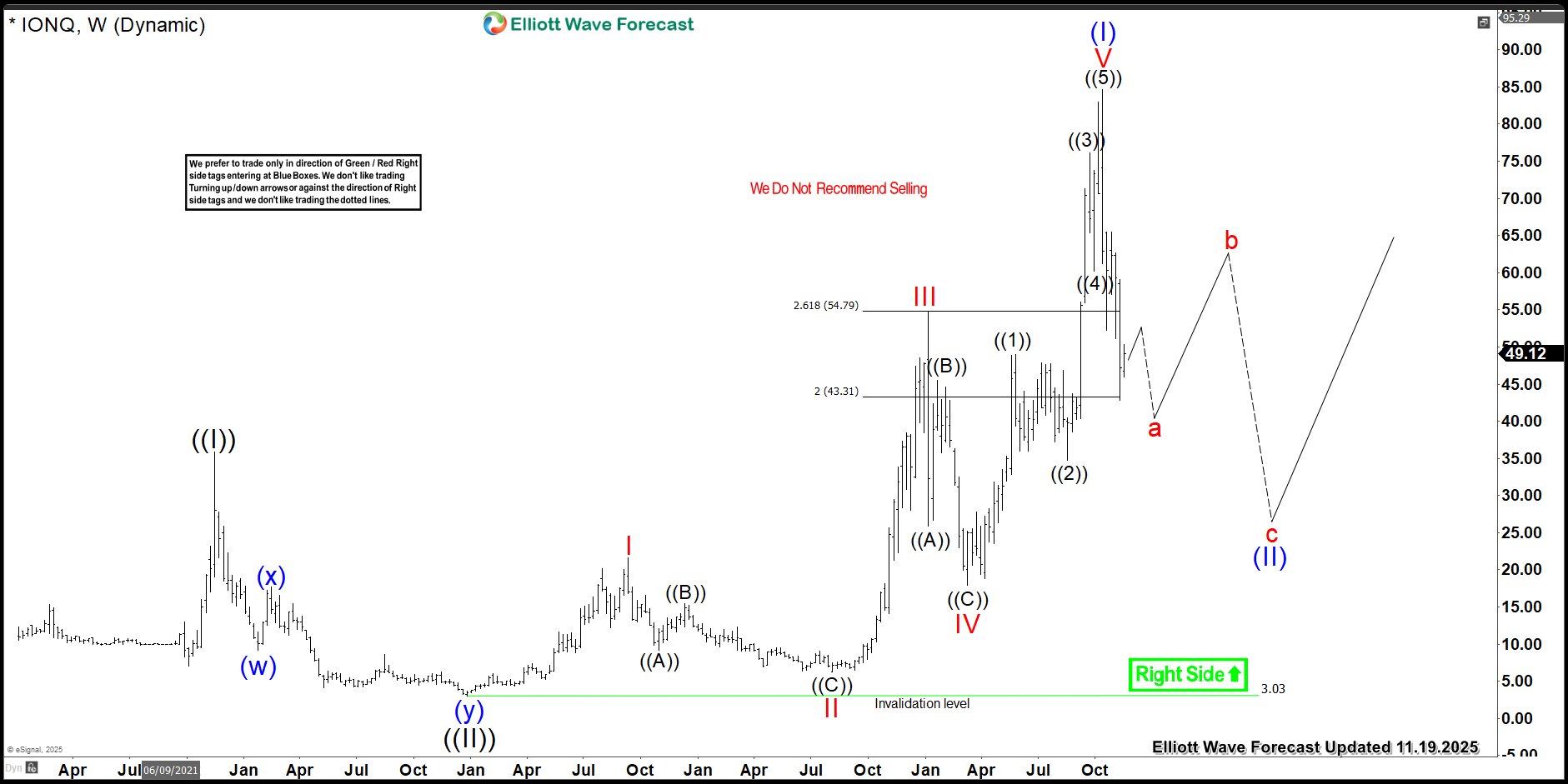

IONQ Latest Elliott Wave Chart From 11.19.2025

This is the latest Elliott wave chart from 11.19.2025 update. In which, the main cycle from all time low still 3 waves rally higher taking place. While the rally from December 2022 low unfolded in a diagonal 5 waves structure where wave I ended at $21.60 high. Wave II pullback ended at $6.22 low, wave III ended at $54.74 high, wave IV pullback ended at $17.88 low. Up from there, the stock made a rally into new high towards $84.64 high and ended wave V thus completed wave (I). Down from there, the stock is probably doing a 3 wave pullback to correct the cycle from December 2022 low within wave (II) pullback. Whereas current leg of the pullback can end in between $$33.38- $25.77 area. Subsequently, can see at least 3 wave reaction higher. Don’t like selling it and swing traders should watch out for clear A-B-C setup from the peak. If you are looking for real-time analysis in Stocks & ETFs then join us with a 14-Day Trial for the latest updates & price action. Success in trading requires proper risk and money management as well as an understanding of Elliott Wave theory, cycle analysis, and correlation. We have developed a very good trading strategy that defines the entry. Stop loss and take profit levels with high accuracy and allow you to take a risk-free position, shortly after taking it by protecting your wallet. If you want to learn all about it and become a professional trader. Then join our service by taking a Trial.

This is the latest Elliott wave chart from 11.19.2025 update. In which, the main cycle from all time low still 3 waves rally higher taking place. While the rally from December 2022 low unfolded in a diagonal 5 waves structure where wave I ended at $21.60 high. Wave II pullback ended at $6.22 low, wave III ended at $54.74 high, wave IV pullback ended at $17.88 low. Up from there, the stock made a rally into new high towards $84.64 high and ended wave V thus completed wave (I). Down from there, the stock is probably doing a 3 wave pullback to correct the cycle from December 2022 low within wave (II) pullback. Whereas current leg of the pullback can end in between $$33.38- $25.77 area. Subsequently, can see at least 3 wave reaction higher. Don’t like selling it and swing traders should watch out for clear A-B-C setup from the peak. If you are looking for real-time analysis in Stocks & ETFs then join us with a 14-Day Trial for the latest updates & price action. Success in trading requires proper risk and money management as well as an understanding of Elliott Wave theory, cycle analysis, and correlation. We have developed a very good trading strategy that defines the entry. Stop loss and take profit levels with high accuracy and allow you to take a risk-free position, shortly after taking it by protecting your wallet. If you want to learn all about it and become a professional trader. Then join our service by taking a Trial.

The post Temporary Pause, Tactical Opportunity: IONQ ABC Setup in Focus appeared first on Elliott Wave Forecast.