On October 11, 2025, the crypto markets went into a tailspin. Bitcoin, Ether, and a whole lineup of altcoins tanked hard within just a few hours. Over $19 billion vanished in liquidations — abruptly and inexorably.

Traders took massive hits followed by countless stop-losses and margin calls, while exchanges struggled to keep up, and social media was immediately flooded with speculation, finger-pointing, and wild theories. It was, without exaggeration, one of the most turbulent days the industry’s ever seen.

The Collateral Trap: Internal Pricing and Systemic Risk

The vulnerability crept out of Binance’s Unified Account system, which allowed users to post a wide array of assets, including collateralized derivatives like wBETH and BNSOL. The flaw wasn’t in the assets themselves, but in how they were valued. Instead of referencing external oracles or redemption prices, Binance relied on its own internal spot market prices. That meant if someone could manipulate the order books, they could instantly devalue the posted collateral and trigger mass liquidations across the platform.

The consequences were immediate and severe. Yet, while the broader crypto market faced significant volatility, asset-backed stablecoins such as USDC and Tether maintained their pegs and demonstrated resilience. In contrast, algorithmic stablecoins struggled to keep up. Some deviated sharply from their dollar targets, others froze redemptions entirely. So the events on October 11 really shattered any lingering confidence in the supposed liquidity of stablecoins. It brought back memories of the Terra (LUNA) collapse in May 2022, when UST lost its peg and $40 billion evaporated from the crypto market instantaneously. That incident exposed serious weaknesses in the crypto architecture, and somehow those vulnerabilities are still in place.

Both events highlight a crucial reality: whether we’re talking about a token or a trading platform, the stability of digital finance hinges on clear, reliable collateral and strong redemption mechanisms. Without these foundations, liquidity is just a fragile illusion waiting to collapse.

Stablecoins Under Stress: A Tale of Two Models

Stablecoins are often dubbed as digital dollars, promising stability, fast transactions, and global reach. But when markets turn volatile, things get complicated. Liquidity, it turns out, is not just about volume or velocity. It’s about structure — how redemption works, what backs the token, and whether that backing can withstand a shock.

The recent crash was a stress test, and many stablecoins failed it. It became clear that having tangible backing matters a lot more than clever programming when the pressure’s on. This isn’t a new debate, but the scale and speed of the October event amazed.

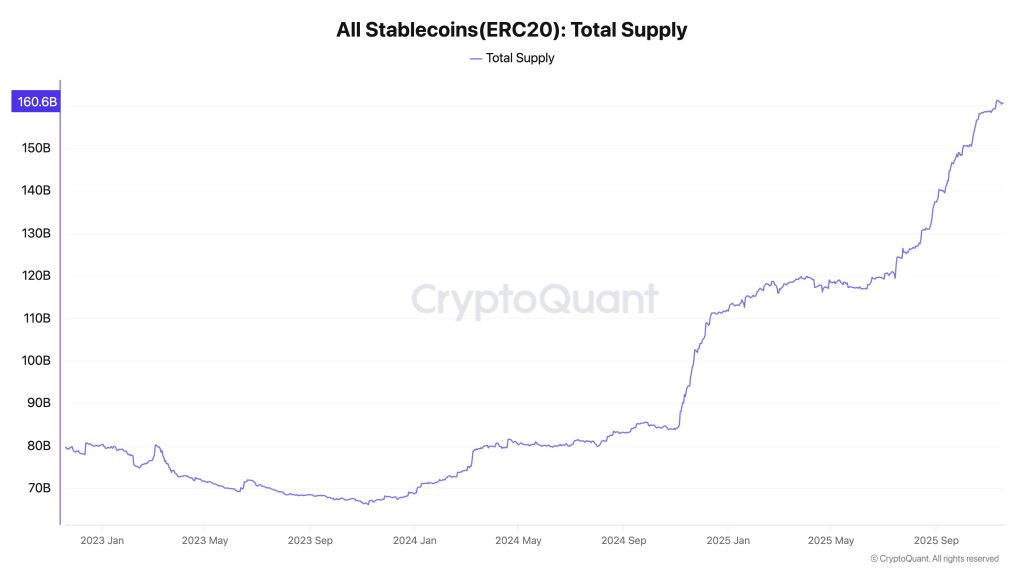

Some analysts predict that the global stablecoin supply could surge to $1 trillion by the end of 2025. It reflects the entire system’s scale and significance. Stablecoins are increasingly used in cross-border payments, DeFi protocols, and even institutional settlement layers. Their liquidity profile matters not just to traders, but to central banks, regulators, and financial institutions exploring digital dollar systems.

However, liquidity in stablecoins can be both resilient and fragile. The illusion of broad liquidity arises when redemption is promised but not guaranteed, or when collateral is opaque, illiquid, or simply limited to unapparent internal pricing. In Binance’s case, the use of internal spot prices created a feedback loop allowing attackers to manipulate collateral values and trigger cascading liquidations. The lesson is clear: pricing and redemption must be anchored in external, verifiable data.

Why TradFi Standards Still Matter in a Crypto World

This brings us to the next phase of stablecoin evolution. It will no longer be defined by just a slew of new tokens or innovative algorithms. It will be shaped by how liquidity is structured, monitored, and redeemed under stress. TradFi has spent decades building standards for collateral, redemption, and risk management. To avoid contagion and earn institutional trust, stablecoins need to start embracing principles that mirror traditional finance, but learn from it rather than blindly mimicking it.

Furthermore, collateral transparency is no longer optional. This means real-time audits, external pricing oracles, and redemption pathways securing unconditional functionality even during market stress. It also means rethinking algorithmic models that promise stability without substance.

Revealed systemic risks sound an alarm. If a single exchange’s pricing mechanism can trigger billions in liquidations, what would happen when stablecoins are deeply integrated into global payment systems? What if a similar attack were launched against a stablecoin used for payroll, remittances, or central bank digital currency settlement?

Liquidity Isn’t Just Volume. It’s a Market Structure

Trust in digital dollar systems isn’t just a matter of robust code. Effective governance, operational transparency, and overall system resilience are crucial in this context. The recent infamous event pointed out that even advanced platforms have their Achilles heel.

Real, unbiased teamwork between regulators and developers is key. The aim shouldn’t just be to mimic the traditional finance playbook; instead, we should focus on creating frameworks to safeguard DeFi innovation by setting up solid liquidity reserves, clear collateral requirements, and stress testing procedures that go beyond theory. They need to be tested and proven in real-world scenarios.

The crypto market will certainly recover. It always does. But the lessons of October 2025 should not be forgotten. In the world of crypto, this carcass structure begins with how we design, value, and redeem our quantums of trust, our digital assets.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views of Cryptonews.com. This article is for informational purposes only and should not be construed as investment or financial advice.

The post Stablecoins Under Fire: Lessons from the October 2025 Crypto Crash appeared first on Cryptonews.