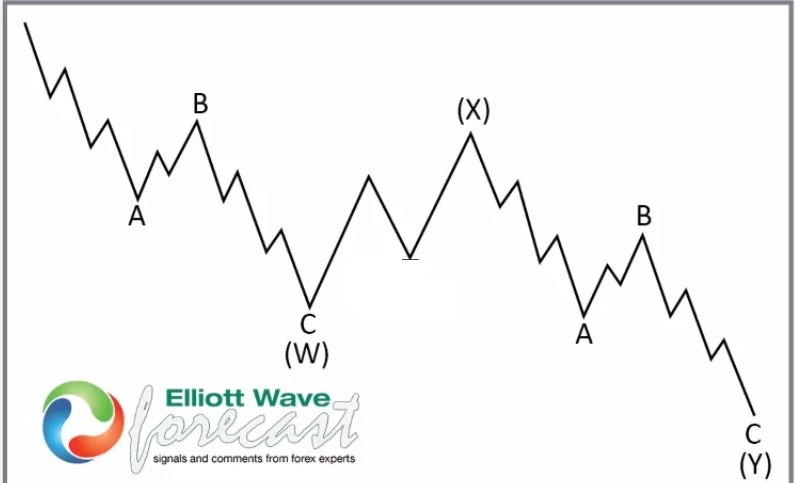

In the 4H Elliott Wave count from July 20, 2025, we saw that $NFLX completed a 5-wave impulsive cycle at black ((1)). As expected, this initial wave prompted a pullback. We anticipated this pullback to unfold in 7 swings, likely finding buyers in the equal legs area between $1199.29 and $1130.90. This setup aligns with a typical Elliott Wave correction pattern (WXY), in which the market pauses briefly before resuming its primary trend.

In the 4H Elliott Wave count from July 20, 2025, we saw that $NFLX completed a 5-wave impulsive cycle at black ((1)). As expected, this initial wave prompted a pullback. We anticipated this pullback to unfold in 7 swings, likely finding buyers in the equal legs area between $1199.29 and $1130.90. This setup aligns with a typical Elliott Wave correction pattern (WXY), in which the market pauses briefly before resuming its primary trend.

$NFLX 4H Elliott Wave Chart 7.27.2025:

The most recent update, from July 27, 2025, shows that the stock has found a low as predicted. After the decline from the June peak, the stock is now finding support from the equal legs area. Currently, it is looking for a corrective bounce towards 1240 – 1280. After that, the stock is expected to continue lower in wave ((2)) before a renewed bullish cycle takes place.

The most recent update, from July 27, 2025, shows that the stock has found a low as predicted. After the decline from the June peak, the stock is now finding support from the equal legs area. Currently, it is looking for a corrective bounce towards 1240 – 1280. After that, the stock is expected to continue lower in wave ((2)) before a renewed bullish cycle takes place.

Conclusion

Elliott Wave Forecast

The post Netflix Inc. $NFLX Blue Box Area Offers A Buying Opportunity appeared first on Elliott wave Forecast.