The Nasdaq has surged 21.86% so far in 2025, nearly ten times Bitcoin’s 2.96% gain, but crypto market maker Wintermute believes the tables could soon turn in favor of BTC.

The Nasdaq-100, a tech-heavy stock index tracking giants like Apple, Microsoft, and NVIDIA, has far outperformed Bitcoin in 2025 as risk appetite concentrated in equities.

According to Wintermute, Bitcoin’s underperformance and heightened sensitivity to stock market losses aren’t signs of weakness, but rather signals of a maturing bottom formation.

Negative Bitcoin-Nasdaq Asymmetry Signals Bottom, Not Breakdown

The correlation between Bitcoin and the Nasdaq-100 remains high, around 0.8, but Bitcoin’s behavior this year is far from typical.

“BTC only seems to move in sync when it hurts,” Wintermute told investors in a recent market report, highlighting how Bitcoin falls sharply on equity sell-offs but barely rises when the Nasdaq gains.

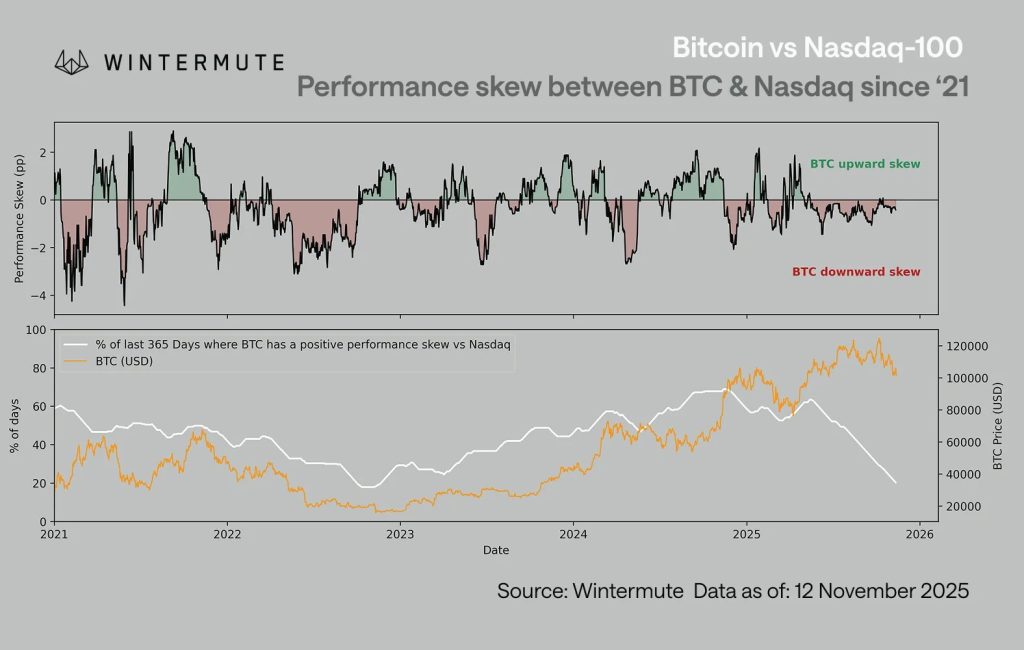

The team measures this through performance skew, showing how much harder Bitcoin falls on Nasdaq down days than it rises on up days.

Currently, that skew is firmly negative. “Bitcoin still trades like a high-beta reflection of risk sentiment, but only when it’s painful,” Wintermute says.

This asymmetry is slowly compressing over time, reflecting Bitcoin’s evolution as a macro asset, yet the pain gap remains elevated.

On a 365-day rolling basis, the negative skew is the highest since late 2022, about a year after Bitcoin peaked during the previous bear market.

Wintermute notes, “Negative asymmetry of this scale usually appears when sentiment is washed out, and historically, it has been a precursor to price recovery.”

The reasons behind Bitcoin lagging Nasdaq by almost 10X are both behavioral and structural.

Wintermute points to a shift in market attention. “Mindshare has moved to equities,” they explain

AI Hype Steals Bitcoin Thunder, But Liquidity Tells Real Story

For much of 2025, the excitement that once drove crypto token launches, infrastructure upgrades, and retail participation has gravitated toward mega-cap tech, especially AI.

This incremental risk appetite has flowed into the Nasdaq rather than digital assets, leaving Bitcoin to act as a high-beta tail of macro risk.

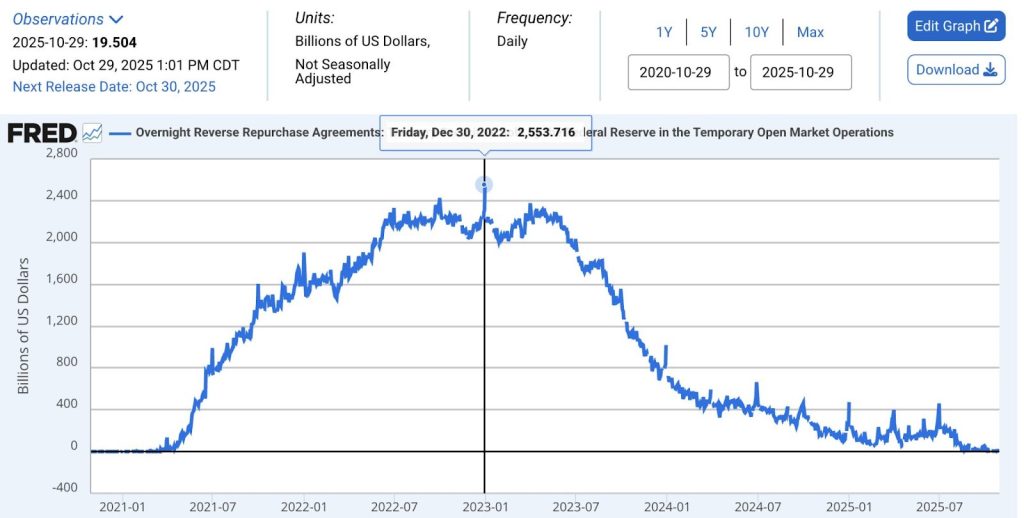

At the same time, crypto’s liquidity profile is more fragile than in previous cycles.

“Stablecoin issuance has plateaued, ETF inflows have slowed, and market depth across exchanges hasn’t recovered to early-2024 levels,” Wintermute points out.

This fragility amplifies negative reactions when equities correct, keeping BTC’s downside participation mechanically higher than its upside.

Wintermute emphasizes that “Historically, this kind of negative asymmetry doesn’t appear near tops but rather shows up near bottoms. When BTC falls harder on bad equity days than it rises on good ones, it usually signals exhaustion, not strength.”

Analysts Converge On BTC Bottom Between $98K-$104k

Despite lagging behind the Nasdaq this year, Bitcoin has held up remarkably well, trading less than 20% off its all-time highs, suggesting that the market’s underlying health is strong.

This aligns with analysis shared by Cryptonews yesterday that seven years’ worth of death cross data shows Bitcoin is close to hitting a structural bottom that could see it shoot to $145K.

Crypto analyst DaanCrypto observed a big liquidity cluster below the local lows at $98K-$100K, which should be taken out soon.

According to his analysis, there’s a local resistance area at ~$108K and If broken, Bitcoin can get back into the bull zone around $112K.

Farzam Ehsani, Co-founder and CEO of VALR, told Cryptonews that Bitcoin holding above $110,000 is vital for it to end the year on a strong note.

According to him, “A decisive reclaim of this range could mark the beginning of a new upside market cycle and open the door for BTC to retest its previous highs and even head higher towards $130,000 before year-end, especially if ETF inflows pick up again.”

The post Nasdaq Up 10x More Than Bitcoin This Year — But Wintermute Calls BTC the Real Bullish Play appeared first on Cryptonews.

(@ImmutableSOL)

(@ImmutableSOL)