Strategy Inc (NASDAQ: MSTR), formerly known as MicroStrategy, remains Bitcoin’s largest corporate holder. However, a stark divergence has emerged throughout 2025. While Bitcoin consistently notches new all-time highs, MSTR stock displays persistent weakness and failing momentum. This disconnect signals underlying technical damage.

Today, we analyze the bearish Elliott Wave sequence explaining this underperformance. Our analysis outlines the critical support levels and downside targets if this corrective phase continues.

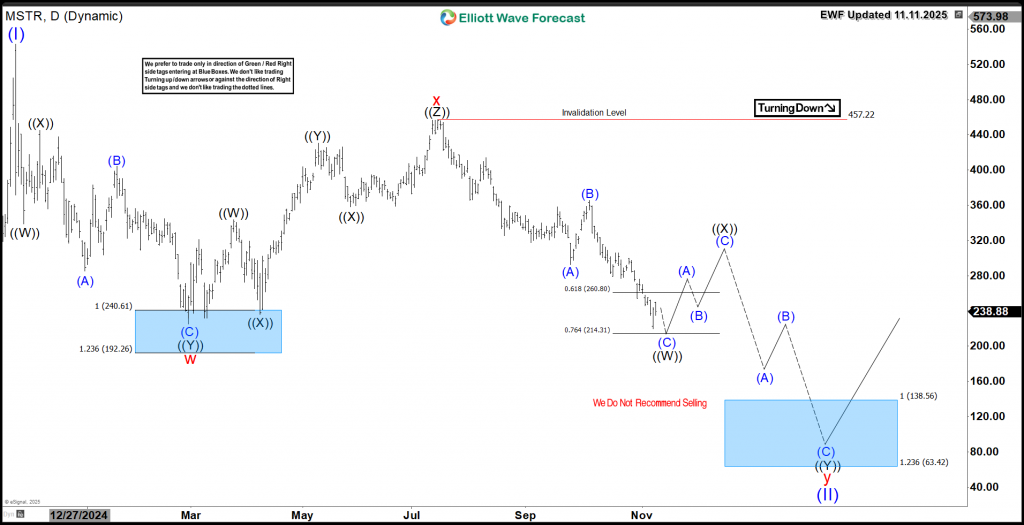

Elliott Wave Analysis

MSTR Daily Chart 11.11.2025

Conclusion

Strategy stock MSTR is undergoing a daily correction. Consequently, traders can use short-term bounces as selling opportunities. Meanwhile, investors should wait for the next extreme area before buying the stock. Use our Elliott Wave strategy to time entries with precision. Enter after a 3-, 7-, or 11-swing correction completes. Additionally, our proprietary Blue Box system highlights high-probability zones with pinpoint accuracy. As a result, this disciplined method gives traders the clarity and confidence to catch the next bullish leg. Explore our system to gain deeper insights into this methodology.

The post MicroStrategy (MSTR) Bearish Shift: The Case for Further Weakness appeared first on Elliott Wave Forecast.