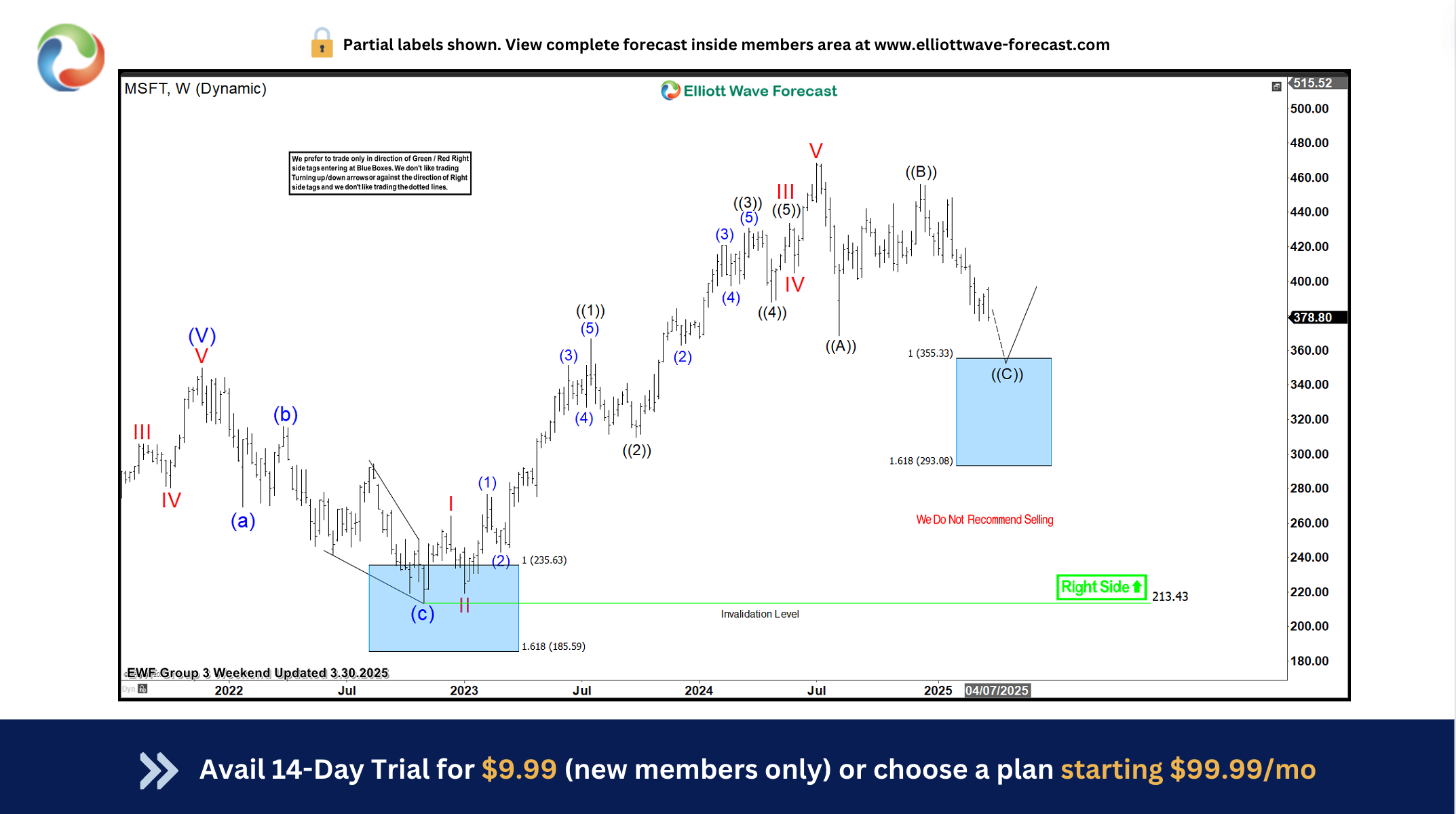

Our Elliott Wave analysis has consistently provided a clear roadmap for $MSFT’s trajectory. On March 30, 2025, our weekly chart showed something key. $MSFT finished a big 5-wave cycle from its October 2022 low. This strong upward push meant a pullback was due. We expected this pullback to be in 3 swings. This is a common Elliott Wave correction (ABC). We thought buyers would step in. The “blue box” area was our target. This was between $355.33 and $293.08. This area often signals a price reversal.

Our Elliott Wave analysis has consistently provided a clear roadmap for $MSFT’s trajectory. On March 30, 2025, our weekly chart showed something key. $MSFT finished a big 5-wave cycle from its October 2022 low. This strong upward push meant a pullback was due. We expected this pullback to be in 3 swings. This is a common Elliott Wave correction (ABC). We thought buyers would step in. The “blue box” area was our target. This was between $355.33 and $293.08. This area often signals a price reversal.

$MSFT Weekly Elliott Wave Chart 6.29.2025:

Fast forward three months to our latest weekly update from June 29, 2025, and the charts tell a compelling story. Microsoft ($MSFT) bounced right from that “blue box.” This wasn’t a small bounce. It was a huge rally, up about 45%! The stock hit new all-time highs. It also reached our first goal: $500. Right now, the stock is still climbing. It is in what we call wave (3) of wave ((1)). This means more gains are likely. We think $MSFT could reach $510–$520 next. After that, we might see another pullback.

Fast forward three months to our latest weekly update from June 29, 2025, and the charts tell a compelling story. Microsoft ($MSFT) bounced right from that “blue box.” This wasn’t a small bounce. It was a huge rally, up about 45%! The stock hit new all-time highs. It also reached our first goal: $500. Right now, the stock is still climbing. It is in what we call wave (3) of wave ((1)). This means more gains are likely. We think $MSFT could reach $510–$520 next. After that, we might see another pullback.

Conclusion

$MSFT Elliott Wave Video Analysis

Elliott Wave Forecast

The post Microsoft $MSFT Soars 45% from Blue Box Area, Reaching Initial $500 Target appeared first on Elliott wave Forecast.