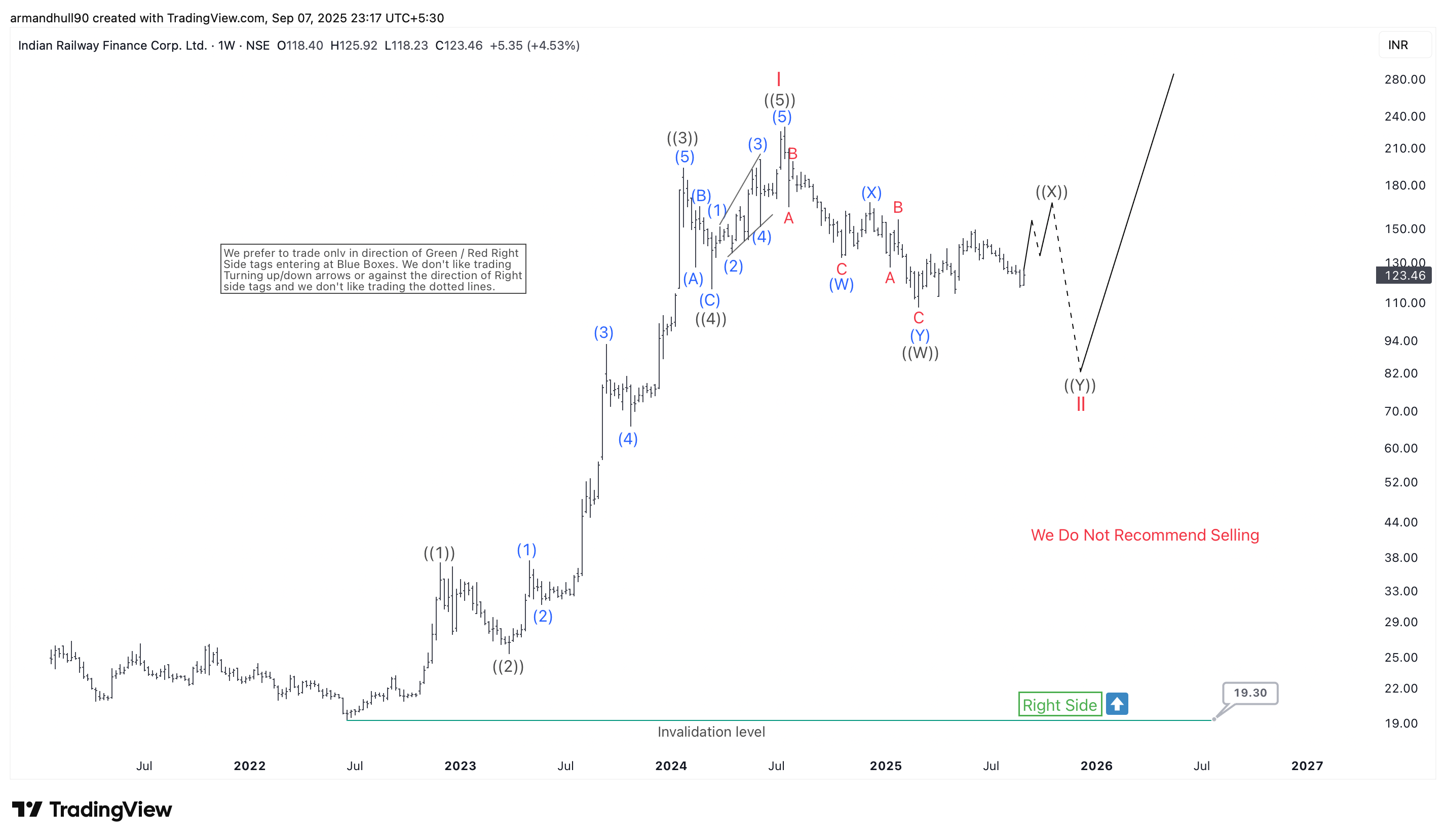

Indian Railway Finance Corporation Ltd. (IRFC) is correcting within a double three Elliott Wave pattern in wave II after completing a strong five-wave rally in wave I.

Indian Railway Finance Corporation Ltd. (IRFC) has maintained a strong bullish trend over the past months. After forming a significant low, the stock started a powerful rally, completing a clear five-wave advance in wave I. This upward move confirmed the larger bullish cycle and showed strong investor confidence.

Currently, IRFC is in a corrective phase within wave II. This pullback aims to retrace part of the prior wave I advance. The correction is forming a double three pattern (W)-(X)-(Y), a common Elliott Wave structure in complex corrections. The first leg, wave ((W)), has already completed. After that, the price bounced in wave ((X)). Now, price action suggests that wave ((Y)) is likely to unfold soon before wave II reaches its base.

The broader bullish view stays valid as long as the price remains above the key invalidation level at ₹19.30. We do not recommend selling at current levels. Instead, traders should prepare for potential buying opportunities once the wave II correction ends.

Once the correction finishes, a strong wave III rally is expected to start. This next bullish leg is likely to take prices to new highs, continuing the long-term uptrend. Investors and traders should watch the upcoming support zones closely, as they may offer attractive low-risk entry points in line with the right-side bullish view.

Explore a variety of Stocks & ETFs investing ideas by trying out our services 14 days and learning how to trade our blue boxes using the 3, 7 or 11 swings sequence. You will get access to our 78 instruments updated in 4 different time frames, Live Trading & Analysis Session done by our Expert Analysts every day, 24-hour chat room support and much more.

The post IRFC Elliott Wave Analysis: Wave II Correction Nearing Completion Before Major Bullish Rally appeared first on Elliott Wave Forecast.