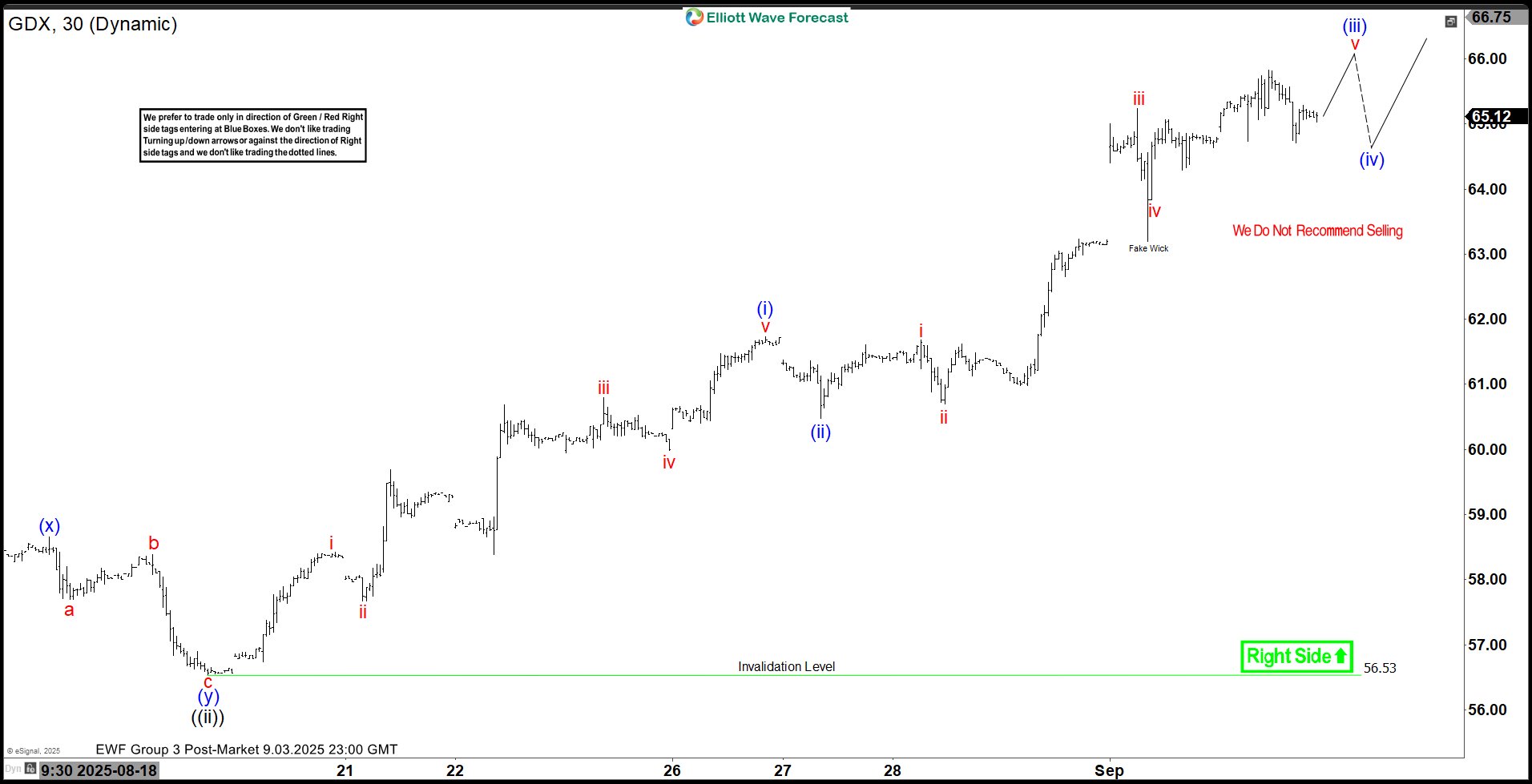

The Short Term Elliott Wave View for the Gold Miners ETF (GDX) indicates a 5-wave impulse cycle from the low on August 11, 2025. The wave ((i)) peaked at 58.88. Then, the wave ((ii)) dip concluded at 56.53. The index has climbed again in wave ((iii)) with a smaller impulse structure. From the wave ((ii)) low, wave (i) reached 61.73. Next, the wave (ii) pullback finished at 60.47. We anticipate wave (iii) will end soon. After that, a wave (iv) pullback should correct the cycle from the August 27, 2025 low. The index will likely rise again in wave (v) to complete wave ((iii)). Expect a series of wave 3-4 and pullback to continue to stay supported. As long as the 56.53 pivot holds, expect pullbacks to find support at the 3, 7, or 11 swing levels. This setup favors more upside. Gold Miners ETF (GDX) – 30 Minute Elliott Wave Technical Chart:

GDX – Elliott Wave Technical Video:

The post GDX Elliott Wave Update: Rally Gains Momentum in Wave ((iii)) appeared first on Elliott Wave Forecast.