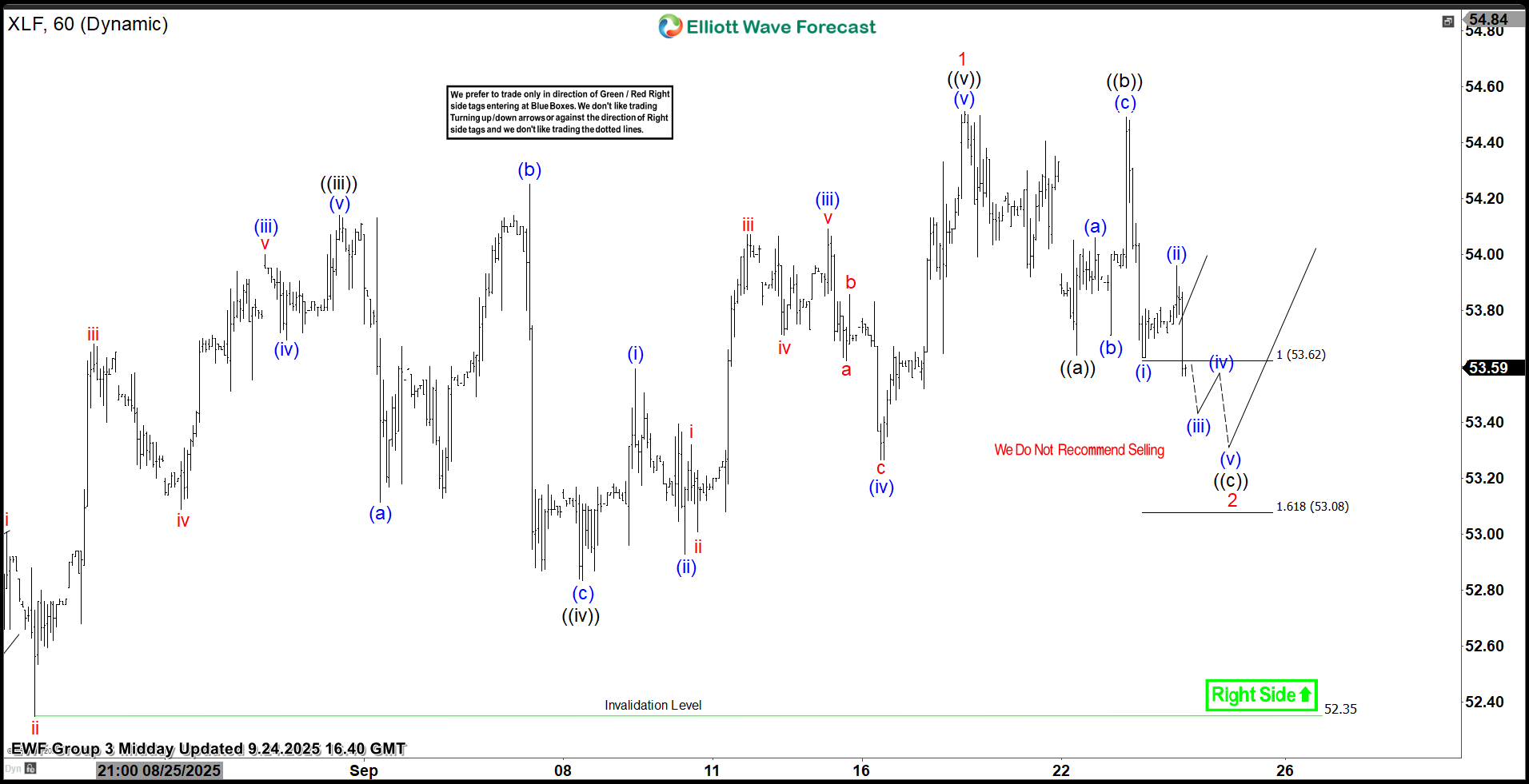

In the 1-hour Elliott Wave count from Sep 24, 2025, we saw that $XLF completed a 5-wave impulsive cycle at red 1. As expected, this initial wave prompted a pullback. We anticipated this pullback to unfold in 3 swings, likely finding buyers in the equal legs area between $53.62 and $53.08. This setup aligns with a typical Elliott Wave correction pattern (ABC), in which the market pauses briefly before resuming its primary trend.

In the 1-hour Elliott Wave count from Sep 24, 2025, we saw that $XLF completed a 5-wave impulsive cycle at red 1. As expected, this initial wave prompted a pullback. We anticipated this pullback to unfold in 3 swings, likely finding buyers in the equal legs area between $53.62 and $53.08. This setup aligns with a typical Elliott Wave correction pattern (ABC), in which the market pauses briefly before resuming its primary trend.

$XLF 1H Elliott Wave Chart 6.23.2025:

The weekend update, from Sep 28, 2025, shows that the ETF bounced as predicted allow longs to get risk free. Currently, it is trading higher in wave ((x)) connector before a double correction takes place. A break above 54.51 will open the next leg higher and negate any lower prices.

The weekend update, from Sep 28, 2025, shows that the ETF bounced as predicted allow longs to get risk free. Currently, it is trading higher in wave ((x)) connector before a double correction takes place. A break above 54.51 will open the next leg higher and negate any lower prices.

Conclusion

Elliott Wave Forecast

The post Financial Select Sector $XLF Extreme Areas Offering Buying Opportunities appeared first on Elliott Wave Forecast.