Ethereum’s stablecoin supply reached a record $165 billion after adding approximately $5 billion in new tokens over the past week, despite declining network revenues.

Token Terminal data shows Ethereum added roughly $1 billion in stablecoins per weekday, while DeFiLlama shows $153.4 billion in total market capitalization with USDT commanding 48.97% dominance.

The growth occurs as centralized exchange stablecoin reserves hit $68 billion globally.

Revenue Decline Amid Stablecoin Growth

Ethereum’s on-chain revenue dropped 44% month-over-month to $14.1 million in August, down from $25.6 million in July, despite ETH reaching record highs of $4,957.

Network fees fell 20% to $39.7 million as the Dencun upgrade reduced layer-2 transaction costs.

The upgrade enhanced scalability but significantly reduced layer-1 fee revenue. Critics warn that low fee revenue undermines platform viability, while supporters argue that Ethereum is evolving into a decentralized finance infrastructure.

Institutional attention continues growing despite revenue concerns. Etherealize raised $40 million in September to promote Ethereum adoption among public companies, building infrastructure for private trading and settlement of tokenized assets, including bonds and fixed income products.

Co-founder Joseph Lubin predicts ETH could rally 100x as Wall Street shifts toward decentralized finance.

He believes Ethereum will replace siloed institutional systems and become the backbone for financial services, staking, and smart contract execution.

Fundstrat’s Tom Lee targets $5,500 near-term with ambitious $12,000 year-end projection.

Lee disclosed that institutional sentiment shifted dramatically following the GENIUS Act’s passage, recognizing Ethereum as foundational blockchain infrastructure supporting over $145 billion in stablecoin supply.

Stablecoin Market Explosion Drives Infrastructure Demand

Global stablecoin transaction volume reached a record $2.5 trillion according to Bridge platform data. Chainalysis reports show USDT processed over $1 trillion monthly between June 2024 and June 2025, peaking at $1.14 trillion in January.

USDC ranged from $1.24 to $3.29 trillion monthly, with particularly high October activity.

Smaller stablecoins experienced rapid expansion with EURC growing 89% month-over-month on average, rising from $47 million to $7.5 billion by June 2025.

PYUSD sustained acceleration from $783 million to $3.95 billion during the same period.

The growth indicates shifting usage patterns with USDC linking to U.S. institutional rails while USDT dominates emerging markets as digital cash.

As a result, Tether is exploring deeper gold exposure by investing across mining, refining, trading, and royalty finance ventures.

The company holds $8.7 billion in gold reserves while considering physical investments on larger scales beyond its $900 million XAUt token.

CEO Paolo Ardoino calls gold “our source of nature,” with Tether acquiring $105 million in Elemental Altus, followed by an additional $100 million investment.

Exchange Consolidation and Infrastructure Competition

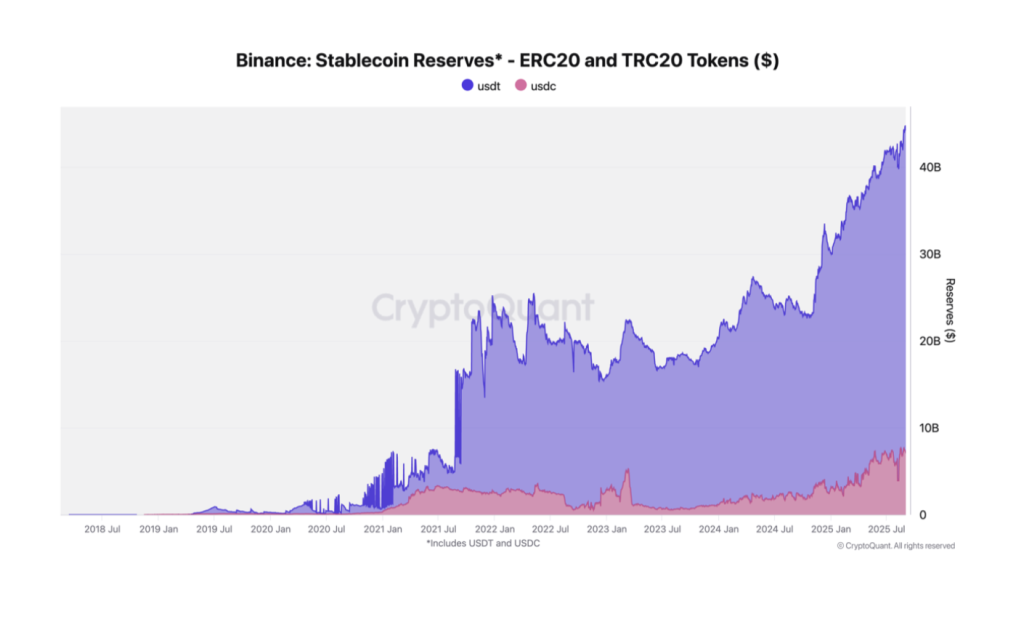

Binance dominates stablecoin reserves with $44.2 billion, representing 67% of all USDT and USDC holdings across exchanges.

The total includes $37.1 billion USDT and $7.1 billion USDC, which notably marks USDC’s resurgence on the platform.

OKX maintains $9.0 billion reserves with a 14% market share, while Bybit holds $4.2 billion and Coinbase $2.6 billion. Competing exchanges experienced stagnant growth as users consolidate activity on larger platforms.

The recent 30-day expansion favored Binance with $2.2 billion increase, and OKX added $800 million. Bybit and Coinbase reserves remained flat.

Amid the booming stablecoin adoption, Stripe launched Tempo blockchain last week, targeting 100,000+ transactions per second with sub-second finality.

The payments-focused Layer 1 features fiat-denominated fees and supports any stablecoin for gas payments through enshrined automated market makers.

Design partners include Visa, Deutsche Bank, Standard Chartered, Anthropic, OpenAI, DoorDash, and Shopify.

The diverse coalition ensures broad payment use case coverage from microtransactions to enterprise payroll systems.

The blockchain completes Stripe’s crypto infrastructure following Bridge’s $1.1 billion acquisition and Privy purchase.

Tempo enables direct transaction processing revenue capture rather than external network fee payments while leveraging extensive merchant networks.

As the stablecoin market is growing fast, treasury projections suggest stablecoin markets could exceed $2 trillion by 2028.

The post Ethereum’s Stablecoin Dominance Grows with $5B Weekly Inflow, Supply Hits $165B Record appeared first on Cryptonews.

(@tokenterminal)

(@tokenterminal)

Stripe’s Tempo blockchain begins testing with financial giants like Visa, Deutsche Bank, and Standard Chartered, targeting 100,000+ TPS for stablecoin payments.

Stripe’s Tempo blockchain begins testing with financial giants like Visa, Deutsche Bank, and Standard Chartered, targeting 100,000+ TPS for stablecoin payments.