Ethereum exchange-traded funds (ETFs) staged a dramatic surge in investor interest, drawing in more than $307 million in net inflows on August 27 alone, leaving their Bitcoin counterparts trailing once again.

The wave of capital shows accelerating institutional demand for Ether, with Wall Street funds increasingly positioning around the second-largest cryptocurrency.

ETH ETFs Catch Up to BTC, But Bitcoin Still Leads at $144B AUM

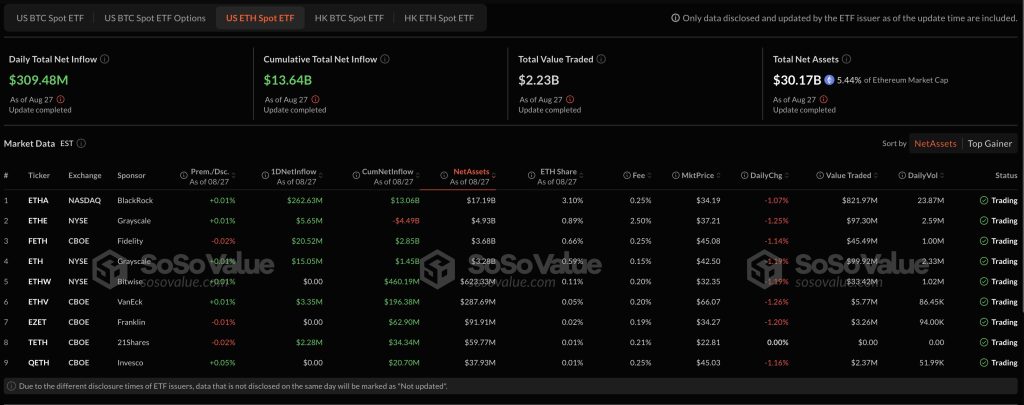

According to data from SoSoValue, U.S.-listed Ethereum spot ETFs now hold $30.17 billion in net assets, equal to 5.4% of Ether’s total market capitalization.

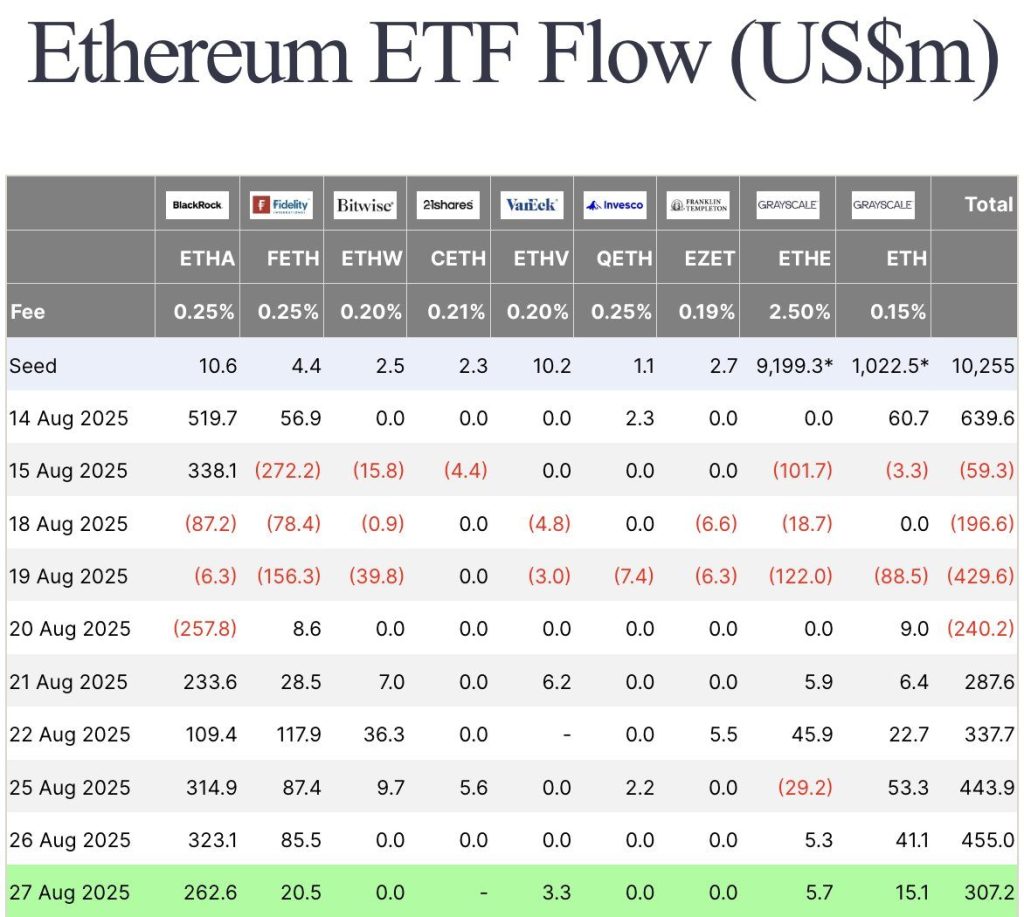

Daily inflows on Tuesday were led by BlackRock’s iShares Ethereum Trust (ETHA), which pulled in $262.6 million, while Fidelity’s FETH attracted $20.5 million. In a sign of shifting sentiment, Grayscale’s flagship ETHE product, which has suffered heavy redemptions since launch, managed to record a rare positive day with $5.7 million in inflows.

The latest surge caps an extraordinary two-week turnaround for Ethereum ETFs. On August 19, the group suffered its worst trading session to date, with a $429 million net outflow, driven largely by redemptions from Fidelity and Grayscale.

But flows rebounded sharply. On August 21, BlackRock alone attracted $233.6 million, while Fidelity added $28.5 million, pushing total net inflows to nearly $288 million.

The recovery gathered momentum, with August 22 bringing $337.7 million in new capital, followed by $443.9 million on August 25 and a record $455 million on August 26.

Cumulatively, Ethereum ETFs have now absorbed $13.6 billion since launch, with nearly one-third of that total arriving in just the past few weeks. Trading activity has been robust, with $2.23 billion in daily turnover across Ether ETF products.

BlackRock remains the dominant player by far, with its ETHA fund controlling $17.19 billion in net assets, more than half of the market. Fidelity’s FETH, at $3.68 billion, and Bitwise’s ETHV, at $3.23 billion, round out the sector’s second tier, while Franklin’s EZET holds under $1 billion.

While Ether products are expanding rapidly, Bitcoin ETFs continue to hold a much larger share of the market. As of August 27, U.S. spot Bitcoin ETFs recorded $81.2 million in daily net inflows, far below Ethereum’s $307 million haul. Collectively, Bitcoin funds now manage $144.6 billion in assets, around 6.5% of Bitcoin’s total market cap.

Trading volumes reached $2.8 billion on the day, with BlackRock’s iShares Bitcoin Trust (IBIT) leading the pack with $50.9 million in fresh inflows and $514 million in daily trading.

BlackRock Rules Both Bitcoin and Ethereum ETFs, But ETH Gains Edge

BlackRock also dominates the Bitcoin side of the market, with IBIT accounting for $83.5 billion of the sector’s assets, or nearly 60% of the total.

Fidelity’s FBTC is the second-largest, with $22.4 billion in assets and $14.6 million in daily inflows, while Grayscale’s GBTC has seen a cumulative $23.9 billion in redemptions despite still holding $20 billion.

Secondary players, including Ark 21Shares and Bitwise, continue to contribute steady but smaller flows.

The divergence in flows shows a decisive shift in momentum toward Ether funds. In just the past five trading days, Ethereum products have attracted $1.8 billion in net inflows, compared with Bitcoin’s more modest gains.

The trend suggests investors are increasingly comfortable diversifying beyond Bitcoin into Ethereum, particularly through low-cost ETFs led by BlackRock and Fidelity.

The flows also reflect an ongoing migration away from legacy Grayscale trusts, which remain hampered by higher fees and sustained redemptions.

Since launch, Grayscale’s ETHE has seen $4.49 billion in net outflows, while GBTC has bled nearly $24 billion, showing investor preference for newer spot-based structures.

Analysts See Trillions Flowing Into Crypto as Advisers Expand ETF Exposure

Investment advisers are emerging as the largest identifiable holders of Bitcoin and Ether exchange-traded funds (ETFs), according to new data from Bloomberg Intelligence.

Bloomberg ETF analyst James Seyffart said on X that advisers invested over $1.3 billion in Ether ETFs during Q2, representing 539,000 ETH, a 68% increase from the previous quarter.

A similar trend was seen in U.S. spot Bitcoin ETFs, where advisers now hold $17 billion across 161,000 BTC. Their exposure is nearly double that of hedge funds.

Seyffart noted that the figures are based on 13F filings with the SEC, which only reflect about 25% of Bitcoin ETF holders. The rest, largely retail investors, are not captured. Still, analysts suggest that financial advisers could play an outsized role once regulatory clarity arrives.

Fox Business has previously projected that trillions in assets could enter crypto markets through adviser allocations.

Institutional interest comes as whales shift strategies. Blockchain analytics firm Arkham reported that nine large wallets purchased $456.8 million worth of Ether this week, with several transactions routed through BitGo and Galaxy Digital.

Lookonchain also tracked another $164 million in ETH bought by newly created wallets via FalconX and Galaxy.

The activity follows diverging price trends. Ether has gained 18.5% in the past month, while Bitcoin has slipped 6.4%.

Some long-term Bitcoin holders are rotating into ETH, including one 2013-era wallet that moved $83 million to Binance.

Analysts say such flows signal a growing preference for Ether, particularly during Bitcoin corrections.

The post Ethereum ETFs Shock Wall Street With $307M Inflows In One Day as Bitcoin ETFs Fall Behind appeared first on Cryptonews.