Spot Bitcoin ETFs returned to strong inflows this week, even as Ethereum funds faced sharp withdrawals, showing a shifting dynamic between the two largest cryptocurrencies.

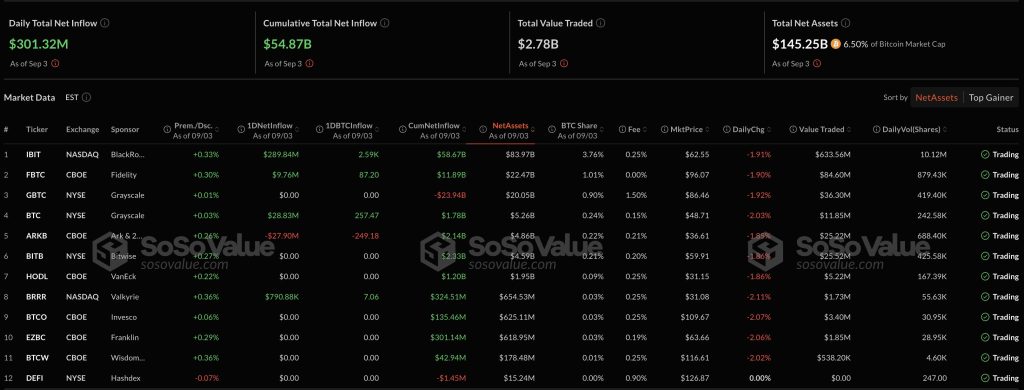

According to data from SoSoValue, Bitcoin spot ETFs posted a net inflow of $301.3 million on September 3, while Ethereum products shed $135.3 million.

Bitcoin ETFs Surge While Ethereum ETFs Reverse August Momentum

BlackRock’s iShares Bitcoin Trust (IBIT) led the charge with $289.8 million in fresh inflows, bringing its assets under management to $58.6 billion.

Grayscale’s Bitcoin Mini Trust followed with $28.8 million, while Ark Invest and 21Shares’ ARKB logged the day’s steepest outflow at $27.9 million.

Across the sector, Bitcoin ETFs now hold a combined $145.2 billion in assets, equal to 6.5% of Bitcoin’s market capitalization, with cumulative inflows reaching $54.8 billion.

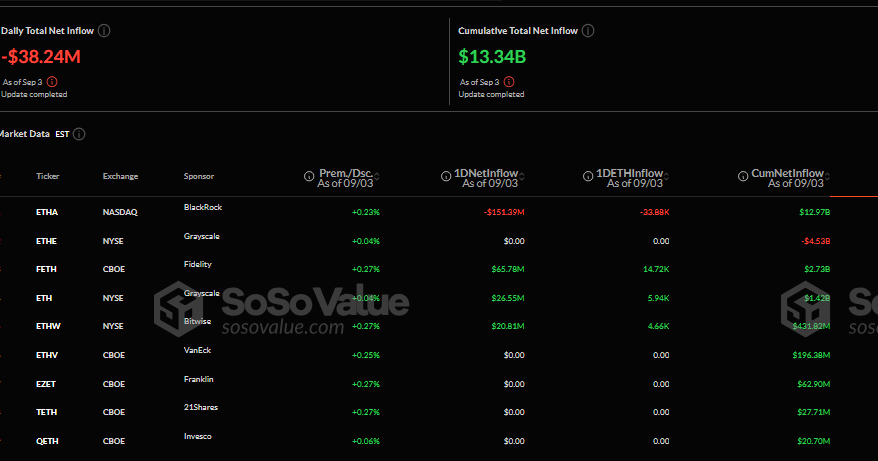

Among Ethereum ETFs, daily net outflows were led by BlackRock’s flagship ETHA fund, which shed $151.9 million. This was followed by Fidelity’s FETH, which added $65.8 million, and Grayscale’s lower-fee Mini Trust, which attracted $62.5 million.

Bitwise logged $20.8 million in fresh inflows, while other issuers such as VanEck, Franklin Templeton, 21Shares, and Invesco saw no major changes.

Despite the setback, cumulative inflows across all Ethereum ETFs remain positive at $13.34 billion, with BlackRock accounting for about $13 billion of that total.

The surge reverses a trend from August, when Ethereum funds dominated activity. ETH products attracted $3.87 billion in inflows last month compared with $751 million in Bitcoin outflows.

Trading volumes showed the divergence, with Ethereum ETF activity jumping to $58.3 billion in August, nearly double July’s total, while Bitcoin volumes slipped to $78.1 billion.

Ethereum also posted a new all-time high of $4,953 in August, supported by corporate treasuries holding a combined $119.6 billion of ETH by the end of the month.

But September is telling a different story. On August 29, Ethereum ETFs logged $164.6 million in outflows, breaking a five-day inflow streak that had added $1.5 billion.

Cumulative inflows remain positive at $13.34 billion, almost entirely concentrated in BlackRock’s ETHA, which accounts for $13.1 billion. Analysts note Ethereum historically struggles in September, citing $46.5 million in ETF outflows during the same month in 2024.

Bitcoin, by contrast, gained $1.26 billion that September, benefiting from risk-off positioning.

Whales Scoop Up $620M in Ether as Institutions Boost Exposure

Despite the latest ETF withdrawals, whale and institutional activity suggest a sustained appetite for Ether.

Last week, nine large addresses purchased $456.8 million worth of ETH, with five wallets receiving transfers from custodian BitGo and others acquiring coins through Galaxy Digital.

Lookonchain data added that newly created wallets accumulated another 35,948 ETH, worth $164 million, within eight hours, with tokens sourced from FalconX and Galaxy Digital.

Institutions are also active. Bitmine received 14,665 ETH worth $65.3 million from Galaxy Digital, while three wallets received 65,662 ETH, valued at $293 million, from FalconX.

Meanwhile, BlackRock deposited 33,884 ETH, worth $148.6 million, into Coinbase Prime. The activity follows reports that the firm sold $151.4 million in ETH while doubling its Bitcoin purchases, illustrating shifting allocations between the two assets.

Ethereum’s relative strength adds context. Over the past month, Ether has gained 18.5%, while Bitcoin has slipped 6.4%. ETH now trades 6.7% below its record high, while Bitcoin remains more than 10% off its $124,500 all-time high earlier this year

Analysts pointed out that some long-term Bitcoin holders are taking profits. A whale who bought BTC in 2013 at $332 recently moved 750 coins, worth $83.3 million, to Binance. On-chain watchers suggested the funds could rotate into Ethereum, echoing earlier transactions where whales sold Bitcoin to buy Ether.

One such trade this month saw 670 BTC, worth $76 million, converted into 68,130 ETH valued at $295 million. Another long-dormant address withdrew 6,334 ETH, worth $28 million, from Kraken after years of inactivity.

Bitcoin Consolidates as Binance Futures Volume Hits $2.6 Trillion

Bitcoin (BTC) is trading at $110,778, down 0.7% in the past 24 hours and 1.9% over the week. The asset remains 10.5% below its $124,500 all-time high.

Notably, over the weekend, BTC dropped to $107,400, its lowest level in seven weeks, before rebounding to $112,000.

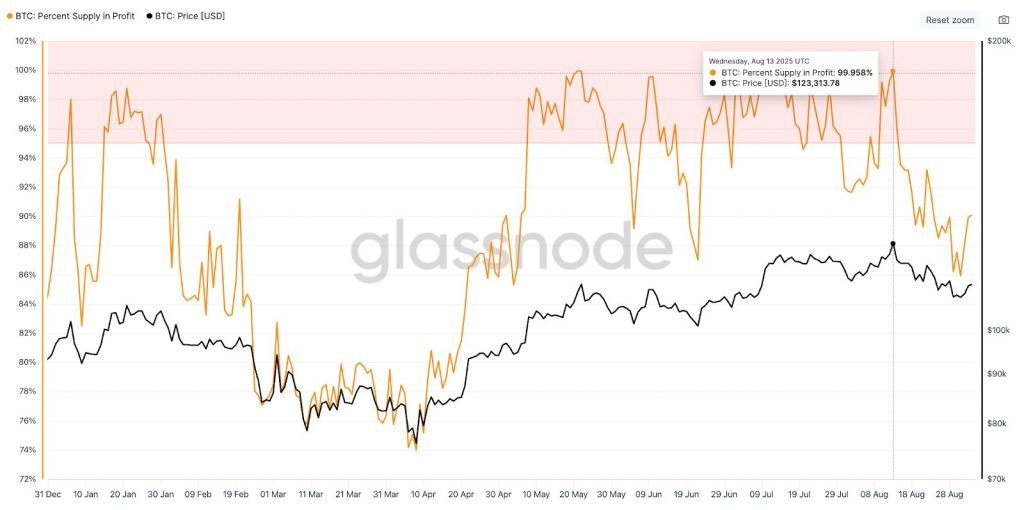

Glassnode data shows the correction cooled the “euphoric phase” that began in mid-August, when 100% of Bitcoin’s supply was in profit.

Sustaining such conditions typically requires strong inflows, which faded by late August. Currently, 90% of supply remains in profit, within the $104,100–$114,300 cost basis range.

Glassnode noted that a break below $104,100 could trigger another post-ATH drawdown, while a recovery above $114,300 would indicate renewed demand.

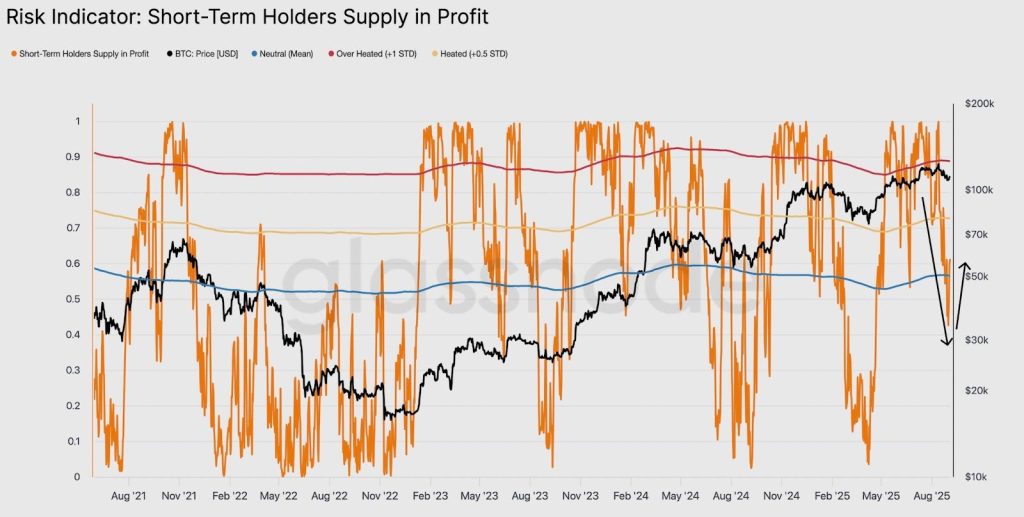

Short-term holders saw profits collapse from above 90% to just 42% during the decline. While the rebound restored profitability to over 60% of their supply, analysts warned that the recovery is fragile.

Glassnode said only a move above $114,000–$116,000, where 75% of short-term holders would be in profit, could restore confidence for a fresh rally.

Resistance remains heavy in the $111,700–$115,500 zone, which aligns with the 50-day and 100-day simple moving averages.

“BTC has been consolidating below its previous local range and has failed to retake it,” trader Daan Crypto Trades noted on X, adding that the $107,000 monthly low may not hold if selling pressure intensifies.

Source: Daan Crypto Trades

Meanwhile, Binance futures trading surged to a record $2.62 trillion in August, up from $2.55 trillion in July, according to CryptoQuant. The spike reflects heightened volatility, increased hedge fund and institutional participation, and rising open interest.

Analysts cautioned that while strong derivatives activity indicates liquidity, futures-driven momentum without stable spot inflows often precedes sharp corrections.

For now, Bitcoin remains range-bound, with bulls needing to reclaim $114,000 to confirm a stronger recovery.

The post Ethereum ETFs Bleed Amid $301M BTC Inflow, Yet Whales Buy More ETH – Here’s Why appeared first on Cryptonews.

Largest Ethereum corporate holder, Bitmine purchased 80,325 ETH from Galaxy Digital and FalconX, valued at $358 million.

Largest Ethereum corporate holder, Bitmine purchased 80,325 ETH from Galaxy Digital and FalconX, valued at $358 million.