The crypto market continues to underperform equities since April, with major assets showing flat movement.

Bitcoin is down over 15% in the last 30 days despite recent macro tailwinds from the Fed rate cut and the announcement to end quantitative tightening (QT) by December.

The S&P 500 has maintained a 1.66% gain in the last 30 days, extending year-to-date gains to 16.76%.

This contrasts sharply with Bitcoin’s mere 4.2% YTD gain, despite being the smaller asset with roughly $2.1 trillion in market cap compared to the S&P 500’s over $60 trillion valuation.

Liquidity Expanding, But Not Into Crypto

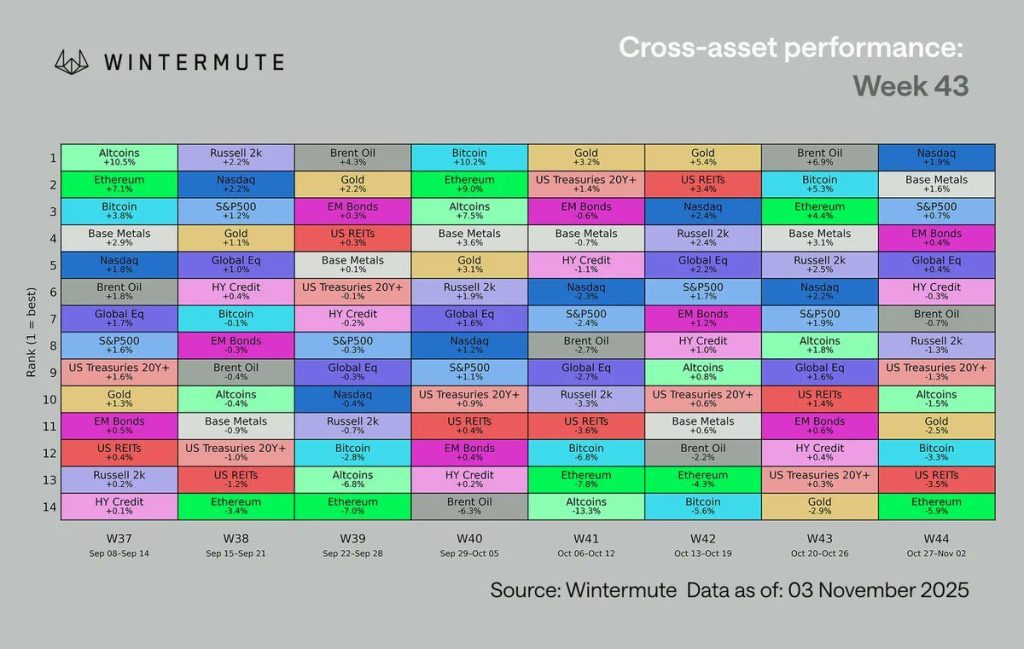

According to the November 2025 market report from crypto market-making fund Wintermute, liquidity is expanding globally, yet capital isn’t reaching the crypto sector.

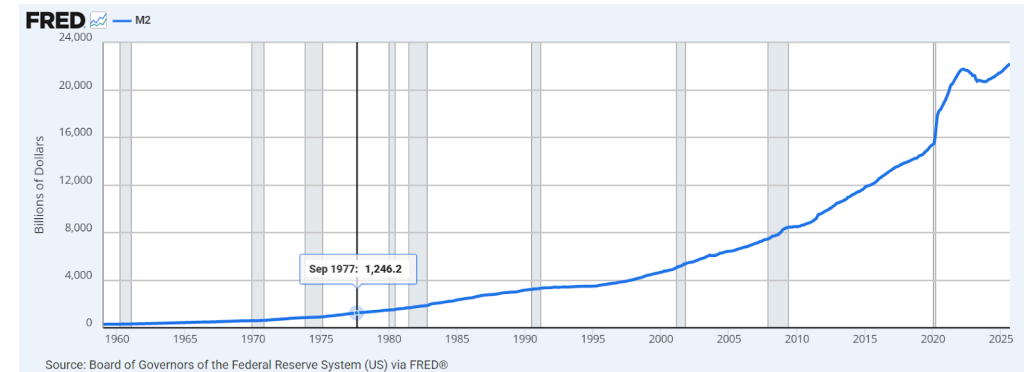

The Federal Reserve’s M2 Money Supply shows liquidity trending upward since June 2023, with an addition of over $2 trillion, now standing at over $22 trillion as of September 2025.

Despite this expansion, crypto ETF inflows have stalled, and digital asset treasury (DAT) activities on blue-chip crypto like Bitcoin, Ethereum, Solana, and BNB have dried up.

“Crypto market structure looks healthy with leverage flushed and positioning clean, but a pickup in ETF or DAT flows will be the key signal for renewed liquidity and a potential catch-up leg,” Wintermute stated.

Fed’s Rate Cut Fails to Lift Crypto

Last week’s Fed rate cut, FOMC minutes, and U.S. tech earnings brought inevitable volatility.

The selloff saw over $19 billion in leverage wiped out.

Some investors got caught leaning too bullish into the event as the 25bps was already priced in.

The concerning part, however, is that equities stabilized quickly, but crypto didn’t bounce.

The crypto market since then has shed over $500 billion, with Bitcoin falling to around $104,000, Ethereum sliding to $3,500, and BNB and SOL down over 20% each.

Most altcoins got slaughtered, with outperformance driven by short-term narratives.

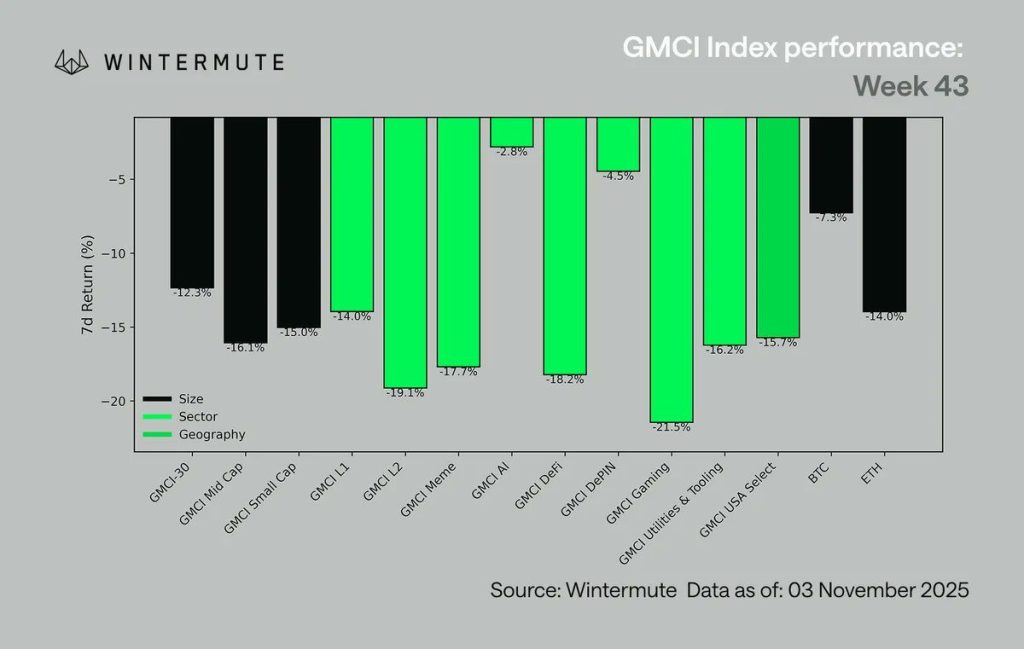

The GMCI-30 dropped 12% last week. Losses were widespread as the Gaming sector went down 21%, L2s down 19%, Memes down 18%, and Mid and Small Caps fell 15-16%.

Only AI (-3%) and DePIN (-4%) showed resilience, helped by strength in names like TAO.

“Compared to other asset classes, crypto is the worst performer,” Wintermute concluded.

Liquidity Restructuring Shows Crypto Bull Run Not Over

Global liquidity is clearly expanding, but Central banks are cutting rates into relative strength, not weakness.

The problem is that incremental liquidity isn’t flowing into crypto like it used to.

Jasper De Maere, crypto strategist at Wintermute, noted that for this reason, “The concept of the four-year cycle is no longer relevant, even as increasingly loud voices on CT are starting to ascribe negative price performance to it.”

The mechanics that once drove the crypto four-year cycle, including miner supply and halving dynamics, no longer matter in a mature market.

What drives performance now is liquidity.

U.S. Government Shutdown Compounds the Problem

On-chain data from CryptoQuant shows the prolonged U.S. government shutdown has directly affected liquidity flow across Bitcoin and the broader crypto market.

According to the Congressional Budget Office, the lapse in federal spending could erase $7–14 billion in economic output.

This means what’s currently unfolding is more than fiscal uncertainty; it’s a liquidity freeze, and the crypto market is reflecting it.

While the CBO expects a temporary rebound once the shutdown ends, on-chain data suggests confidence and capital will take longer to recover.

“For Bitcoin, this period is not a simple dip to buy—it’s a stress test of conviction, liquidity, and patience in a market shaped by fiscal dysfunction,” concluded an analyst from XWIN Research Japan.

The post Crypto Underperforms Equities Market Despite Rate Cuts and QT End – Bull Run Over? appeared first on Cryptonews.

“Uptober” is looking more like “Downtober.” Bitcoin is off 6% this month, and with macro headwinds building, analysts see a key test ahead.

“Uptober” is looking more like “Downtober.” Bitcoin is off 6% this month, and with macro headwinds building, analysts see a key test ahead.  Liquidity STRESS is rising:

Liquidity STRESS is rising: