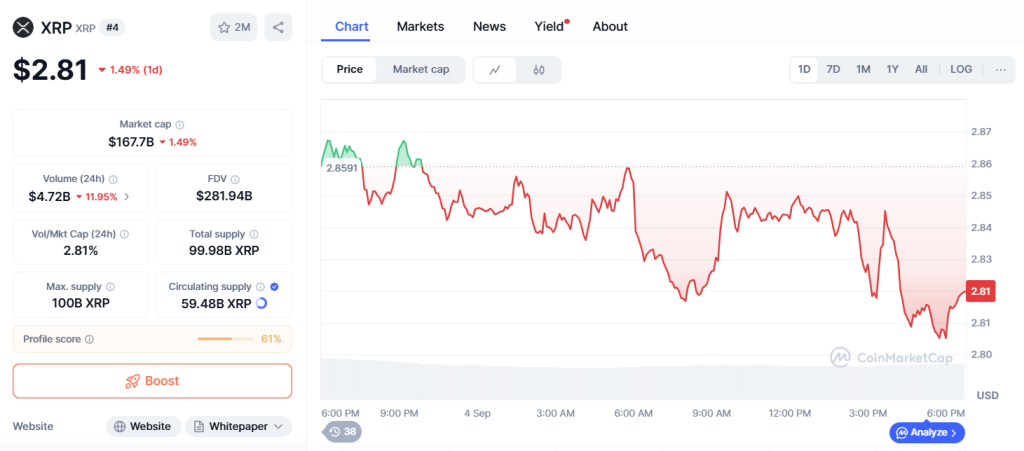

ChatGPT’s XRP analysis has revealed XRP consolidating at $2.8133 with a 0.99% decline while testing resistance from all major EMAs, as RLUSD stablecoin crosses a $700 million market cap with $3.2 billion in transfers.

At the same time, XRP is trading below key EMAs, creating a comprehensive bearish structure while SWIFT partnership trials and ETF speculation provide fundamental catalyst potential.

ChatGPT’s XRP analysis synthesizes 22 real-time technical indicators to assess XRP’s trajectory as it tests the EMA resistance cluster and potential breakout formation.

Comprehensive EMA Resistance Testing

XRP’s current price of $2.8133 reflects a -0.99% decline from the opening price of $2.8414, establishing a tight consolidation range between $2.8482 (high) and $2.8040 (low).

This 1.6% intraday range demonstrates controlled volatility typical of consolidation phases below multiple resistance levels.

The RSI at 46.07 maintains neutral positioning, providing balanced momentum without oversold conditions.

Moving averages reveal challenging bearish positioning with XRP trading below all visible EMAs: 20-day at $2.8580 (+1.6%), 50-day at $2.8549 (+1.5%), and 100-day at $2.9077 (+3.4%), creating a layered resistance structure.

MACD shows mixed signs with slight bullish positioning at 0.0029 above zero, but the signal line at 0.0004 and negative histogram at -0.0026 suggest momentum deterioration.

Additionally, volume analysis shows moderate activity at 25.68 million XRP, indicating steady institutional participation during resistance testing phases.

ATR maintains high readings at 2.9704, suggesting substantial volatility potential for continued moves once consolidation resolves and directional clarity emerges.

RLUSD Adoption Validates Ecosystem Growth

XRP’s consolidation occurs amid major fundamental developments, with RLUSD stablecoin achieving major adoption milestones.

Community analysis shows “RLUSD just crossed $700M MC & $3.2B in transfers, fastest-growing stablecoin on the planet,” demonstrating ecosystem expansion beyond XRP token utility.

Ripple’s strategic partnerships continue expanding with collaborations including Chipper Cash, Valr, and Yellow Card, making RLUSD available to institutions worldwide.

Additionally, SWIFT partnership trials create catalyst potential with community discussions emphasizing “SWIFT’s Ripple trial could turn XRP into the backbone of global payments.”

Recent confirmation that “SWIFT will not generate digital assets, positioning its network to support assets like XRP instead of compete” validates strategic positioning.

Brad Garlinghouse’s presence at Federal Reserve roundtables was also reported, which indicates institutional engagement at the highest levels.

Strong Metrics Support Ecosystem Development

XRP maintains substantial positioning with a $167.11 billion market cap despite a -2% decline during consolidation phases.

The market cap adjustment accompanies reduced volume at $4.65 billion (-17.03%). The 2.77% volume-to-market cap ratio suggests controlled trading activity during consolidation phases below resistance levels.

A circulating supply of 59.48 billion XRP represents 59.5% of the maximum 100 billion supply, with controlled release supporting network economics during institutional adoption phases.

The market’s dominance of 4.41% (+0.04%) shows slight strength relative to the broader crypto market during consolidation.

A fully diluted valuation of $280.97 billion reflects the total network value, including future token releases, while current pricing maintains a 26.74% discount on the 2018 all-time high.

Current pricing secures extraordinary 100,330% gains from 2014 lows while testing key resistance levels.

Ecosystem Confidence Amid Technical Challenges

LunarCrush data reveals moderate social performance with XRP’s AltRank at 253 during consolidation phases.

Galaxy Score of 49 (-12) reflects balanced sentiment as participants process RLUSD adoption against technical resistance challenges.

Engagement metrics show declining activity with 6.18 million total engagements (-1.62M) while mentions increase to 40.75K (+15.69K), demonstrating continued attention during fundamental developments.

Social dominance of 3.05% maintains visibility while sentiment registers a robust 83% positive.

Recent social themes have focused on RLUSD validation, with community discussions emphasizing stablecoin growth metrics and institutional partnership expansion.

Major developments include CME data showing “XRP futures contracts were the fastest-ever to hit $1B in open interest,” according to Brad Garlinghouse.

Prominent analysts are also identifying resistance testing patterns, with some noting “XRP is trying to flip resistance,” while others emphasize fundamental strength, arguing “if the prevailing attitude towards XRP was that it is unwanted it wouldn’t still be the 3rd largest crypto in existence.”

ChatGPT’s XRP Analysis: Ecosystem Validation Meets Technical Resolution

ChatGPT’s XRP analysis has revealed that XRP is positioned between major ecosystem validation through RLUSD adoption and comprehensive EMA resistance testing, requiring breakout confirmation.

Immediate resistance emerges at the 50-day EMA around $2.8549, followed by the 20-day EMA ($2.8580) and 100-day EMA ($2.9077).

Breaking above these levels would validate ecosystem strength, driving momentum toward the $2.95–$3.00+ psychological resistance levels.

Support begins at today’s low around $2.8040, followed by key support at $2.7800–$2.7500 levels.

The technical setup suggests consolidation resolution required for fundamental thesis validation, with moderate volume indicating continued institutional positioning despite surface resistance challenges.

Three-Month XRP Price Forecast: Ecosystem-Driven Scenarios

Ecosystem Breakout (45% Probability)

Successful break above $2.855 EMA resistance combined with continued RLUSD adoption could drive XRP toward $3.00–$3.30, representing 7–17% upside from current levels.

This scenario requires validation of institutional confidence and confirmation of resistance breakthrough.

Extended Consolidation (35% Probability)

Continued resistance testing could result in consolidation between $2.75–$2.90, allowing ecosystem development progress while technical indicators reset for the next major directional move toward ETF speculation targets.

Support Testing (20% Probability)

Breaking below $2.804 support could trigger selling toward $2.750–$2.700 levels, representing 2–4% downside.

Recovery would depend on ecosystem validation and major support defense during fundamental catalyst development.

ChatGPT’s XRP Analysis: Infrastructure Development Meets Technical Breakout

ChatGPT’s XRP analysis has revealed XRP at a key juncture between ecosystem infrastructure validation and technical resistance resolution.

The combination of RLUSD adoption milestones with comprehensive EMA resistance creates a compelling setup requiring breakout confirmation for trend continuation.

Next Price Target: $3.00-$3.30 Within 90 Days

The immediate trajectory requires a decisive break above $2.855 resistance to validate ecosystem development over technical challenges.

From there, RLUSD adoption acceleration could propel XRP toward $3.00 psychological resistance, with sustained institutional partnership progress driving toward $3.30+ breakout levels.

However, failure to break $2.855 would indicate extended consolidation toward $2.75–$2.80 range, creating an accumulation opportunity before the next ecosystem wave drives XRP toward $4.00+ targets.

The post ChatGPT’s XRP Analysis: Price Consolidates at $2.81 as RLUSD Tops $700M Cap appeared first on Cryptonews.

SWIFT CONFIRMS IT WILL NOT GENERATE DIGITAL ASSETS, POSITIONING ITS NETWORK TO SUPPORT ASSETS LIKE XRP INSTEAD OF COMPETE

SWIFT CONFIRMS IT WILL NOT GENERATE DIGITAL ASSETS, POSITIONING ITS NETWORK TO SUPPORT ASSETS LIKE XRP INSTEAD OF COMPETE