ChatGPT’s DOGE analysis has revealed that Dogecoin is consolidating at $0.22030 with a 1.61% decline, while testing resistance from all major EMAs. The network hashrate has reached all-time highs, strengthening security infrastructure amid growing altseason speculation and institutional positioning.

ChatGPT’s DOGE analysis synthesizes 21 real-time technical indicators to assess Dogecoin’s trajectory as it navigates comprehensive EMA resistance and potential breakout formation.

Technical Analysis: Comprehensive EMA Resistance Testing

Dogecoin’s current price of $0.22030 reflects a 1.61% decline from the opening price of $0.22390, establishing a tight consolidation range between $0.22518 (high) and $0.22013 (low).

This 2.3% intraday range shows controlled volatility typical of consolidation phases below multiple resistance levels.

The RSI at 48.52 maintains neutral positioning, providing balanced momentum without oversold or overbought conditions.

Moving averages reveal a challenging bearish positioning with Dogecoin trading below all major EMAs: the 20-day at $0.22081 (+0.2%), the 50-day at $0.22243 (+1.0%), the 100-day at $0.22339 (+1.4%), and the 200-day at $0.23103 (+4.7%).

The MACD also shows mixed signs, with a slight bullish positioning at 0.00084 above zero. However, the signal line at -0.00045 and the negative histogram at -0.00129 suggest a deterioration in momentum.

Similarly, volume analysis shows exceptional activity at 185.71 million DOGE, indicating strong whale participation during resistance testing phases.

ATR also maintains high readings at 0.19785, suggesting substantial volatility potential despite current tight consolidation range characteristics.

Network Strength Meets Altseason Positioning

Dogecoin’s consolidation occurs amid major network developments, with the hashrate reaching all-time highs, strengthening security infrastructure.

The hashrate milestone indicates increased mining participation and network resilience during market uncertainty.

Recent market dynamics are sending mixed indicators, with $200 million in DOGE transferred to Binance, creating downward pressure on the price.

Meanwhile, Binance data reveals that 75% of accounts are maintaining long positions, expecting rebounds. This positioning dichotomy reflects institutional distribution against retail optimism during altseason speculation phases.

Analysts note Dogecoin “lags behind Ethereum after Ethereum breaks all-time highs,” suggesting potential catch-up momentum if altseason rotation accelerates toward established meme coins.

The 2025 trajectory exhibits volatility, ranging from January’s $0.33 peak to spring’s $0.16–$0.17 consolidation, followed by July’s $0.24 recovery and the current $0.22 positioning.

Strong Network Metrics Support Positioning

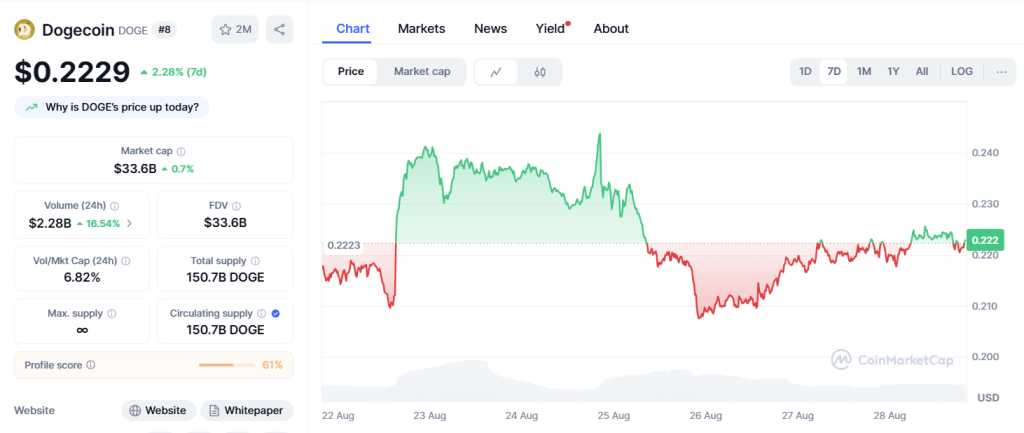

Dogecoin maintains a substantial market position with a $33.46 billion market cap (+0.49%), despite challenges from EMA resistance.

The market cap growth accompanies increased volume at $2.31 billion (+18.3%), indicating active institutional repositioning during network milestone achievements.

The 6.91% volume-to-market cap ratio suggests healthy trading activity, supporting price stability during resistance-testing phases.

Source: CoinMarketCap

The circulating supply of 150.7 billion DOGE represents the current distribution, with an unlimited maximum supply reflecting the ongoing inflationary mechanics that support network security incentives.

With a market dominance of 0.86%, Dogecoin positions itself as a leading meme coin, boasting proven resilience.

Fully diluted valuation of $33.47 billion reflects total network value, while current pricing maintains a 70% discount to the 2021 all-time high of $0.7376, providing substantial upside potential.

Current pricing secures extraordinary 258,783% gains from 2015 lows while testing key resistance levels.

Social Sentiment: Network Strength Amid Technical Challenges

LunarCrush data reveals moderate social performance with Dogecoin’s AltRank at 172 during network milestone achievements.

A Galaxy Score of 53 reflects a balanced sentiment as participants process hashrate records versus technical resistance challenges.

Engagement metrics indicate a decline in activity, with 3.89 million total engagements (-25,890) while mentions increase to 34.2K (+12,950), demonstrating continued attention.

The social dominance of 2.4% maintains meme coin visibility, while sentiment registers at a robust 81% positive, despite technical challenges.

Recent social themes have focused on network security validation, with community discussions emphasizing “hashrate hits all-time high” and historical pattern analysis suggesting that “2025 launchpad is ready.”

Technical analysis highlights similarities to previous cycles, with potential for major moves once the resistance level is broken.

ChatGPT’s DOGE Analysis: Network Strength Meets Resistance Resolution

ChatGPT’s DOGE analysis reveals Dogecoin at a key juncture between network strength validation and comprehensive EMA resistance testing.

The hashrate milestone demonstrates fundamental improvement, while the technical structure requires breakout confirmation for trend continuation.

Immediate resistance emerges at the 20-day EMA around $0.22081, followed by layered resistance at 50-day ($0.22243), 100-day ($0.22339), and 200-day ($0.23103) EMAs.

Breaking above these levels would indicate validation of network strength, driving momentum toward $0.24–$0.25 targets.

Support begins at today’s low around $0.22013, followed by key support at $0.21500–$0.22000 levels.

The technical setup suggests consolidation resolution required for altseason participation, with high volume indicating continued whale interest despite surface resistance challenges.

Three-Month Dogecoin Price Forecast: Altseason Scenarios

Network-Driven Breakout (40% Probability)

A successful break above the $0.2208 EMA resistance, combined with continued network strength, could drive Dogecoin toward $0.24–$0.27, representing a 9-23% upside from current levels.

This scenario requires altseason rotation validation and resistance breakthrough confirmation.

Extended Consolidation (35% Probability)

Continued EMA resistance testing could result in consolidation between $0.21 and $0.23, allowing for network development progress while technical indicators reset for the next directional move during altseason positioning.

Support Testing (25% Probability)

Breaking below the $0.2201 support level could trigger selling pressure toward the $0.2100–$0.1950 range, representing a 5–12% downside.

Recovery would depend on network strength validation and major support defense during altseason preparation.

ChatGPT’s DOGE Analysis: Network Milestones Meet Technical Resolution

ChatGPT’s DOGE analysis reveals Dogecoin is positioned between network strength validation and comprehensive resistance testing, requiring breakout confirmation.

The hashrate milestone provides a fundamental catalyst while the EMA resistance structure demands technical validation for altseason participation.

Next Price Target: $0.24-$0.27 Within 90 Days

The immediate trajectory requires a decisive break above $0.2208 resistance to validate network strength over technical challenges.

From there, the altseason rotation could propel Dogecoin toward the $0.24 psychological resistance, with sustained network development driving it toward recovery levels of $0.27 and above.

However, failure to break $0.2208 would indicate extended consolidation toward $0.21–$0.215 range, creating an accumulation opportunity before the next altseason wave drives DOGE toward $0.35+ targets as network fundamentals compound with market rotation dynamics.

The post ChatGPT’s DOGE Analysis Reveals EMA Resistance Test at $0.22 as Network Hashrate Hits All-Time High appeared first on Cryptonews.

(@cantonmeow)

(@cantonmeow)  Dogecoin’s official account just hinted at a “possible threat” behind its hashrate ATH.

Dogecoin’s official account just hinted at a “possible threat” behind its hashrate ATH.

(@Tokenoya)

(@Tokenoya)