Cathie Wood’s Ark Invest is increasing its bet on Bullish Holdings, the crypto exchange backed by billionaire Peter Thiel, with a new $11.98 million share purchase this week.

The latest buy marks Ark’s continued accumulation of Bullish stock (BLSH) following its public debut in August.

According to Ark’s Monday trading disclosure, the investment firm acquired a total of 238,346 Bullish shares across three of its actively managed exchange-traded funds.

The flagship ARK Innovation ETF (ARKK) picked up 164,214 shares, the ARK Next Generation Internet ETF (ARKW) bought 49,056 shares, and the ARK Fintech Innovation ETF (ARKF) added 25,076 shares.

Together, the purchases bring Ark’s total investment in Bullish to more than $209 million since the exchange went public.

Ark Invest Keeps Faith in Bullish, Boosting Exposure After Exchange’s U.S. Expansion

Bullish shares now make up 0.97% of ARKK, 0.98% of ARKW, and 1.18% of ARKF. The addition comes despite recent volatility; Bullish stock (BLSH) traded nearly flat on Monday, closing 0.61% lower at $50.26.

The stock has declined 22.45% in the past month and remains down roughly 47% from its August debut.

Ark initially invested $172 million in Bullish shares during the company’s New York Stock Exchange listing at $37 per share.

The August offering, one of the largest crypto IPOs of 2025, valued Bullish at around $5.4 billion and raised $1.1 billion through the sale of 30 million shares.

Ark and BlackRock both expressed early interest in the deal, showing institutional confidence in Bullish’s exchange model and regulatory footing.

Founded in 2021 and headquartered in the Cayman Islands, Bullish combines centralized infrastructure with blockchain-based transparency. The exchange targets institutional and professional traders and has processed more than $1.5 trillion in cumulative trading volume since launch.

In September, Bullish secured both the BitLicense and Money Transmission License from the New York State Department of Financial Services, a key milestone that allowed it to launch spot trading across 20 U.S. states, including New York, California, and Florida.

Will Ark’s Bullish Bet Pay Off or Repeat the Pain of 2022?

Bullish’s strong regulatory momentum has coincided with improving financials. The exchange reported a net profit of $108.3 million in the second quarter of 2025, reversing a $116.4 million loss a year earlier.

Adjusted revenue for the period came in at $57 million, down from $67 million in the prior year, while trading volume reached $179.6 billion. The company is scheduled to release its third-quarter earnings on November 19.

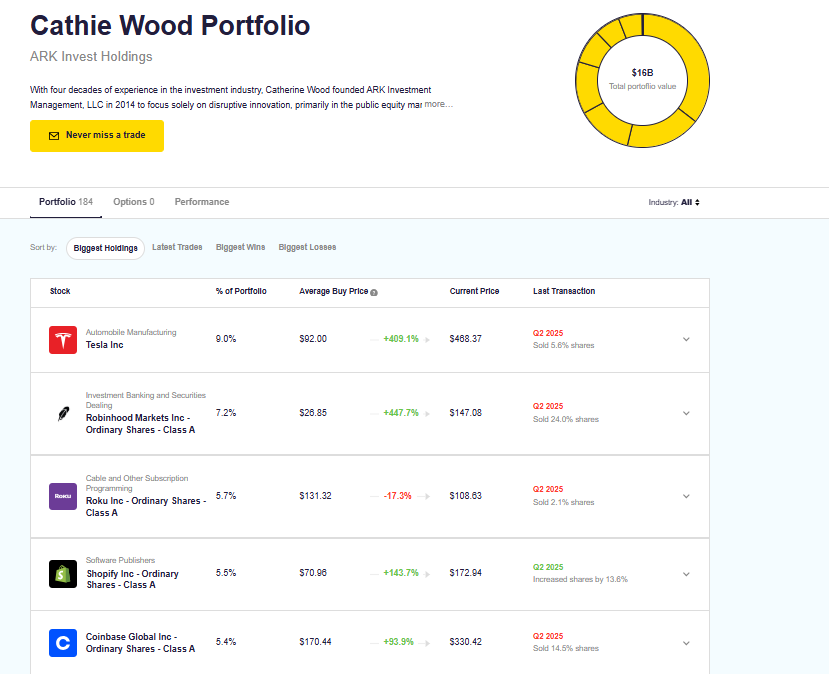

Ark’s latest purchase aligns with its long-standing strategy of investing in what it calls “disruptive innovation.” The firm manages more than $16 billion in assets and focuses on high-growth sectors, including artificial intelligence, robotics, genomics, and blockchain technology.

The ARK Innovation ETF, Ark’s flagship fund with $8.4 billion in assets, is heavily weighted toward technology and crypto-linked companies.

Its top holdings include Tesla (12.32%), Coinbase (5.86%), Roku (5.73%), and Robinhood (4.8%).

Bullish’s growing presence in the portfolio signals Ark’s confidence in the exchange’s role within the evolving digital asset ecosystem.

Ark’s crypto-related exposure across its main ETFs, ARKK, ARKW, and ARKF, now exceeds $2.15 billion, covering equities like Coinbase, Robinhood, and Circle Internet Group, as well as direct holdings via the ARK 21Shares Bitcoin ETF (ARKB).

As of Oct. 31, the flagship Ark Innovation ETF (ARKK) is up 54.5% year to date, far outpacing the S&P 500’s gain of 16.3%.

Wood’s remarkable 153% return in 2020 helped build her reputation and attract loyal followers.

Her strategy can lead to sharp gains during bull markets but also painful losses, as seen in 2022, when ARKK dropped by more than 60%.

The post Cathie Wood Doubles Down on Bullish, Snapping Up Another $12M in Shares — What Does Ark Know? appeared first on Cryptonews.