Short Term Elliott Wave View in Dollar Index (DXY) suggests the decline from 1.13.2025 peak is taking the form of an impulse with extension (nesting). Down from there, wave 1 ended at 106.97 and rally in wave 2 ended at 109.88. The ETF extended lower in wave 3 which is unfolding in 5 waves in…

Categoria: Uncategorized

Elliott Wave View: Nasdaq (NQ) Has Reached Support Area

Nasdaq (NQ) has reached the extreme area from 12.16.2024 peak and thus the Index may see support soon for a 3 waves rally at least. Near term, decline from 2.18.2025 peak is in progress as a 5 waves diagonal. Down from 2.18.2025 peak, wave 1 ended at 22102.75 and wave 2 rally ended at 22299.75….

QuantumScape’s (QS) Shares: Waiting for the Spark to Ignite the Rally

QuantumScape Corporation (QS) develops and commercializes solid-state lithium-metal batteries. These batteries power electric vehicles and other applications, delivering higher energy density and faster charging compared to traditional lithium-ion batteries. QS Weekly Chart March 2025 The price action of QS shares has broken a significant support level, indicating the continuation of a downward trend. Consequently, this bearish…

Why Johnson & Johnson’s (JNJ) Rally Might Be Short-Lived

Johnson & Johnson (JNJ) is an American multinational corporation founded in 1886 that develops medical devices, pharmaceuticals, and consumer packaged goods. Its common stock is a component of the Dow Jones Industrial Average, and the company is ranked No. 36 on the 2021 Fortune 500 list of the largest United States corporations by total revenue….

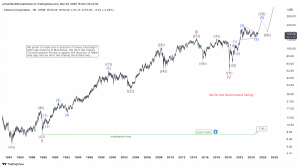

Chevron Corporation (CVX) Poised for Further Gains in Wave (V)

Elliott Wave analysis suggests Chevron (CVX) is extending higher in Wave (V), with bullish momentum intact and further upside potential ahead. Chevron Corporation (CVX) continues to show strong bullish momentum, with the Elliott Wave structure pointing to further upside as Wave (V) unfolds. In the past, the stock completed a major impulsive Wave III, followed…

GOLD (XAUUSD) Elliott Wave: Buying the Dips at the Blue Box Area

Hello fellow traders, As our members know we have had many profitable trading setups recently. In this technical article, we are going to present another Elliott Wave trading setup we got in GOLD (XAUUSD) . The commodity completed its correction precisely at the Equal Legs zone, referred to as the Blue Box Area. In the…

EUROSTOXX (SX5E) Made New Highs From Blue Box Area

In this technical blog, we will look at the past performance of the Elliott Wave Charts of the Eurostoxx (SX5E) index. We presented to members at the elliottwave-forecast. In which, the rally from the 19 November 2024 low is unfolding as an impulse structure. And showed a higher high sequence with a bullish sequence stamp favored more upside…

Is Nu Holdings (NU) Ready For Next Rally ?

NU Holdings Ltd., (NU) provides digital banking platform in Brazil, Mexico, Colombia, Germany, Argentina, United States & Uruguay. It offers spending solutions comprising credit & prepaid cards, mobile payment solutions & integrated mall that enables customers to purchase goods & services from various ecommerce retailers. It is based in Brazil, comes under Financial services sector…

Elliott Wave View: Gold (XAUUSD) Turning Higher from Blue Box

Short Term Elliott Wave View in Gold (XAUUSD) suggests that cycle from 12.18.2024 low is in progress as a 5 waves impulse. Up from 12.18.2024 low, wave 1 ended at 2956.15 as the 1 hour chart below shows. Pullback in wave 2 unfolded as a double three Elliott Wave structure. Down from wave 1, wave…

Consumer Discretionary ETF $XLY Blue Box Area Offers A Buying Opportunity

Hello everyone! In today’s article, we’ll examine the recent performance of Consumer Discretionary ETF ($XLY) through the lens of Elliott Wave Theory. We’ll review how the rally from the August 065 2024, low unfolded as a 5-wave impulse and discuss our forecast for the next move. Let’s dive into the structure and expectations for this stock. 5 Wave Impulse Structure…