Hello Traders! Today, we will look at the Daily Elliott Wave structure of Bitfarms Ltd ($BITF) and explain why the stock is primed for more upside.

Bitfarms, a global and publicly traded Bitcoin mining company, develops, owns, and operates vertically integrated mining farms. Their operations, which have in-house management and company-owned electrical engineering and repair centers, use a proprietary data analytics system that delivers best-in-class performance and uptime. Currently, Bitfarms operates 10 farms in four countries: Canada, the United States, Paraguay, and Argentina.

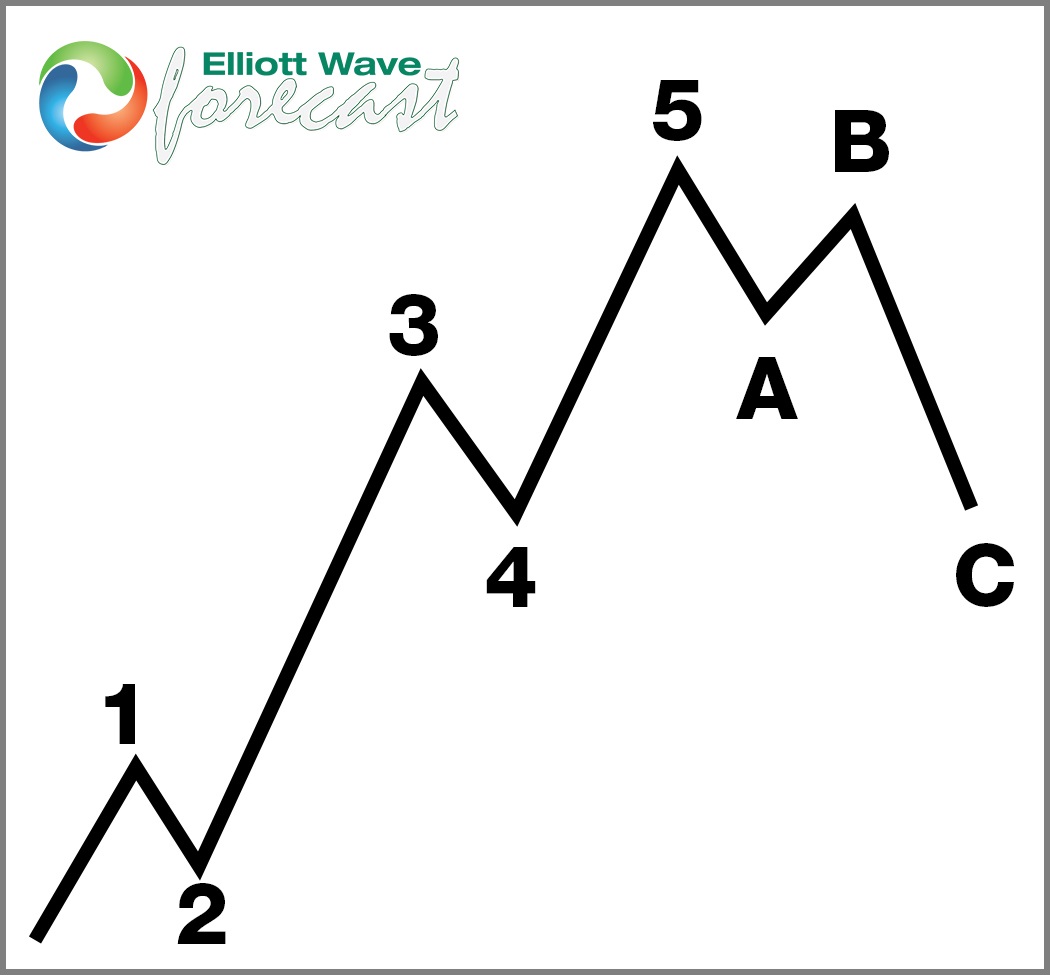

We’ll review how the rally out of December 2022 low unfolded as a 5-wave impulse followed by a 3-swing correction (ABC) and discuss our forecast for the next move. Let’s dive into the structure and expectations for this stock.

5 Wave Impulse Structure + ABC correction

As a result, after wave (2) finished at the June 2025 low, the stock began the next major leg higher. This is wave (3). Furthermore, our proprietary RSI Pivot System has confirmed this move. The system provides a bullish signal for the start of this new rally. This next leg could potentially drive the price back toward its previous high near $4.20.

Conclusion

Elliott Wave Forecast

The post Bitfarms Ltd. $BITF Can Reach $4.20 as Elliott Wave Signals a Bullish Move appeared first on Elliott wave Forecast.