Bitcoin continues to drift lower despite a wave of bullish long-term commentary from prominent investors. The cryptocurrency trades near $95,200, down slightly in the past 24 hours, with a live market cap of $1.89tn and roughly 19.94mn BTC in circulation.

While short-term sentiment remains fragile, recent buying interest from well-known figures such as Rich Dad Poor Dad author Robert Kiyosaki is adding a new layer of confidence to the long-term outlook.

Robert Kiyosaki Sees Bitcoin Hitting $250K Amid Market Dip, Urges Buying Strong Assets

Kiyosaki has reiterated his call for Bitcoin to reach $250,000, arguing that the latest decline is part of a broader adjustment driven by rising global debt, slowing economic growth, and governments resorting to increased money creation.

In his view, assets with fixed supply, including Bitcoin, stand to benefit in an environment where traditional currencies lose purchasing power.

He has confirmed plans to accumulate more BTC once markets stabilize, putting the focus back on Bitcoin’s scarcity and its adoption curve.

Kiyosaki also expects gold to reach $27,000 and silver to climb to $100, framing these assets as anchors in a world where monetary systems face structural strain. His stance has resonated with investors looking for indicators that large players view the recent dip as a long-term entry point rather than a sign of deeper trouble.

Bitcoin (BTC/USD) Tests Breakdown Zone as Momentum Weakens

Bitcoin price prediction is bearish as BTC is trading below the $102,000–$107,000 supply zone, previously the neckline of a double-bottom breakout, has shifted momentum decisively toward sellers.

A firm rejection from the descending 20-EMA reinforces the pressure, with price now contained inside a developing descending channel. The RSI sits near the mid-30s, indicating waning momentum but no confirmed bullish divergence yet.

Price action remains sensitive around the former breakout zone. Attempts to reclaim higher ground have met resistance, suggesting that buyers are waiting for clearer signals before re-entering with conviction.

Downside Levels in Play as Trendline Break Holds

A significant longer-term trendline extending from the March lows has now broken, indicating a shift from trend exhaustion to a deeper retracement phase.

If Bitcoin follows its current path, a short-term recovery toward $99,000–$102,000 is possible, but this zone may now function as a bearish retest rather than a new support base.

Failure to reclaim the 20-EMA opens the risk of a slide toward $91,800, while a deeper correction toward $83,200 becomes likely if price forms another lower high or prints a bearish engulfing pattern near resistance.

BTC Outlook: Rally Potential Amid Structural Weakness

A bullish break above $102,000 accompanied by rising volume and an RSI push above 50 would signal that buyers are regaining control, potentially driving BTC toward $107,000, followed by $116,000. For now, however, caution remains justified as the chart leans bearish.

Still, long-term conviction remains intact. If liquidity conditions improve and institutional flows return, Bitcoin may move back into a sustainable advance, aligning with the optimistic forecasts of investors like Kiyosaki.

For traders positioning early, the coming weeks could define the next major leg of Bitcoin’s multi-year trajectory.

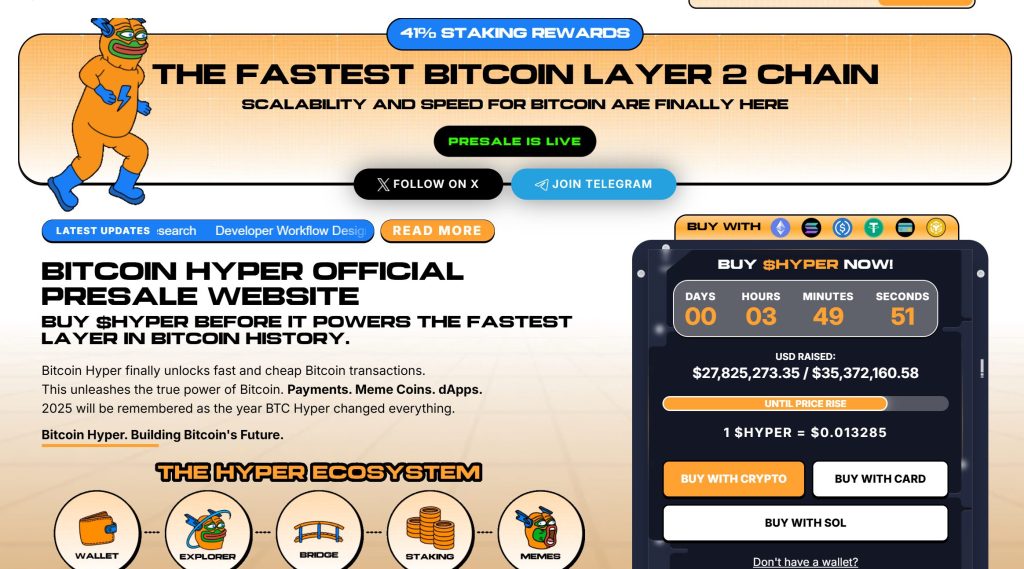

Bitcoin Hyper: The Next Evolution of BTC on Solana?

Bitcoin Hyper ($HYPER) is bringing a new phase to the Bitcoin ecosystem. While BTC remains the gold standard for security, Bitcoin Hyper adds what it always lacked: Solana-level speed. The result: lightning-fast, low-cost smart contracts, decentralized apps, and even meme coin creation, all secured by Bitcoin.

Audited by Consult, the project emphasizes trust and scalability as adoption builds. And momentum is already strong. The presale has surpassed $27.8 million, with tokens priced at just $0.013285 before the next increase.

As Bitcoin activity climbs and demand for efficient BTC-based apps rises, Bitcoin Hyper stands out as the bridge uniting two of crypto’s biggest ecosystems. If Bitcoin built the foundation, Bitcoin Hyper could make it fast, flexible, and fun again.

Click Here to Participate in the Presale

The post Bitcoin Price Prediction: Rich Dad Poor Dad Author Buys More Bitcoin During Crash – What Does He Know? appeared first on Cryptonews.