The Bitcoin price today is $113,865 with 24-hour trading volume of $50.4 billion. While markets remain focused on near-term technical levels, Central Asia is emerging as an unlikely driver of the next phase of global Bitcoin adoption.

Central Asia Turns to Bitcoin

Kyrgyzstan joins Kazakhstan in creating a Bitcoin reserve, as the region piles up digital assets. The Kyrgyz parliament has approved a framework to create a state entity that will mine BTC using excess hydro power.

According to Economy Minister Bakyt Sydykov, only 10% of the country’s hydro potential is currently tapped, leaving vast capacity to support a national Bitcoin reserve.

Turnover on Kyrgyzstan’s 13 crypto platforms exceeded $11 billion in the first seven months of 2025—200 times more than in 2022. While some platforms get sanctioned for Russian transactions, the sector is growing fast. Prime Minister Sadyr Zhaparov told international partners “don’t politicize the economy” as Bitcoin becomes part of national resilience.

- Kyrgyz turnover: $11B in Jan–July 2025

- Hydro capacity exploited: only 10%

- New projects: 15 small hydro plants under construction

Global Reserve Currency Ambitions

Kazakhstan just followed, with President Tokayev announcing a state funded digital asset reserve. Russia is already moving resources to BTC, Japan, South Korea and Taiwan are exploring similar. The United States remains dominant with 35% of global hash power, compared with 17% for Russia and 15% for China.

Analysts argue this steady accumulation could eventually position Bitcoin as a credible global reserve asset. ETFs continue to expand, corporations are adopting Bitcoin as a treasury hedge, and on-chain data shows long-term holders adding to positions.

Senator Cynthia Lummis’ proposed “Bitcoin Act” in Washington, which targets one million BTC for U.S. reserves, could accelerate this trajectory.

Technical Outlook for Bitcoin

On the four-hour chart, Bitcoin price prediction remains bullish as BTC trades at $114,070 inside an ascending triangle. The 50-EMA ($111,731) has crossed above the 200-EMA ($112,534), a bullish confirmation supported by higher lows since late August. RSI at 62 shows momentum building but not yet overextended.

Candlestick patterns—Doji pauses followed by stronger bullish closes—suggest growing buyer conviction. A break above $115,400 could unlock upside toward $117,150 and $118,617. Failure to breach resistance risks a retracement to the $113,395 pivot or deeper into the $112,000–$110,000 support zone.

For traders, a close above $115,400 with volume is a buy signal to $117,000–$118,600 with stops below $112,000. Longer term, above $118,600 could be a path to $130,000, making Bitcoin not just a speculative asset but a reserve currency.

Presale Bitcoin Hyper ($HYPER) Combines BTC Security With Solana Speed

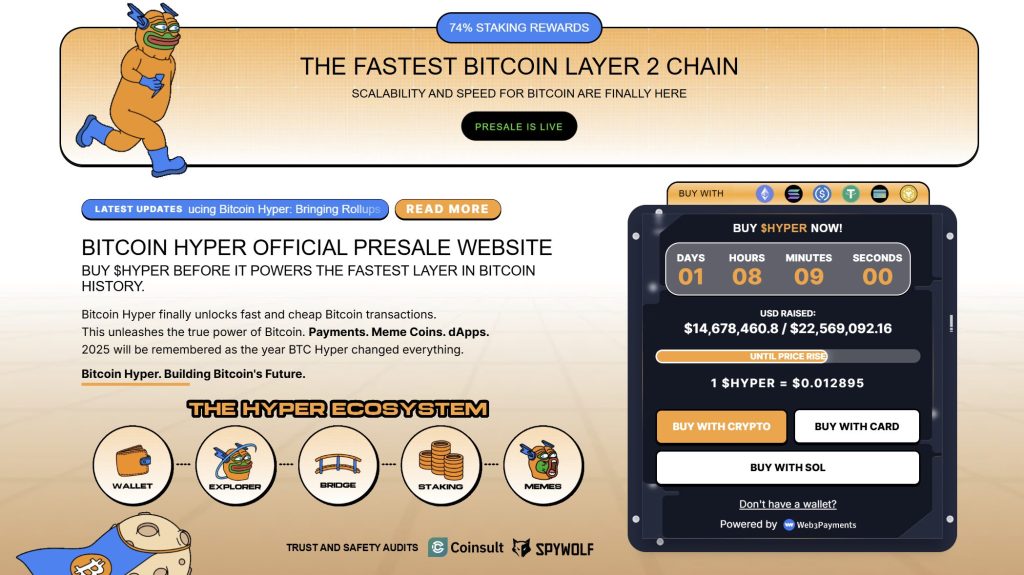

Bitcoin Hyper ($HYPER) is positioning itself as the first Bitcoin-native Layer 2 powered by the Solana Virtual Machine (SVM). Its goal is to expand the BTC ecosystem by enabling lightning-fast, low-cost smart contracts, decentralized apps, and even meme coin creation.

By combining BTC’s unmatched security with Solana’s high-performance framework, the project opens the door to entirely new use cases, including seamless BTC bridging and scalable dApp development.

The team has put strong emphasis on trust and scalability, with the project audited by Consult to give investors confidence in its foundations.

Momentum is building quickly. The presale has already crossed $15 million, leaving only a limited allocation still available. At today’s stage, HYPER tokens are priced at just $0.012895—but that figure will increase as the presale progresses.

You can buy HYPER tokens on the official Bitcoin Hyper website using crypto or a bank card.

Click Here to Participate in the Presale

The post Bitcoin Price Prediction: Central Asian Nations Quietly Accumulating Bitcoin – Could BTC Become a Global Reserve Currency? appeared first on Cryptonews.

Senator Cynthia Lummis calls to revise tax laws unfairly targeting Bitcoin and digital assets.

Senator Cynthia Lummis calls to revise tax laws unfairly targeting Bitcoin and digital assets.