U.S.-traded spot Bitcoin ETFs saw total net outflows of $869.86 million on Thursday, recording the second-largest since the launch.

Per SoSoValue data, Grayscale Mini Trust (BTC) recorded the largest outflow of $318.2 million, followed by BlackRock (IBIT), which saw $256.6 million bleed. Meanwhile, Fidelity (FBTC) and Bitwise (BITB) had $119.93 million and $47.03 million in net outflows, respectively.

Investors have pulled out around $2.64 billion in the past three weeks, signalling industry-wide caution due to looming regulatory developments, market corrections, and macroeconomic events.

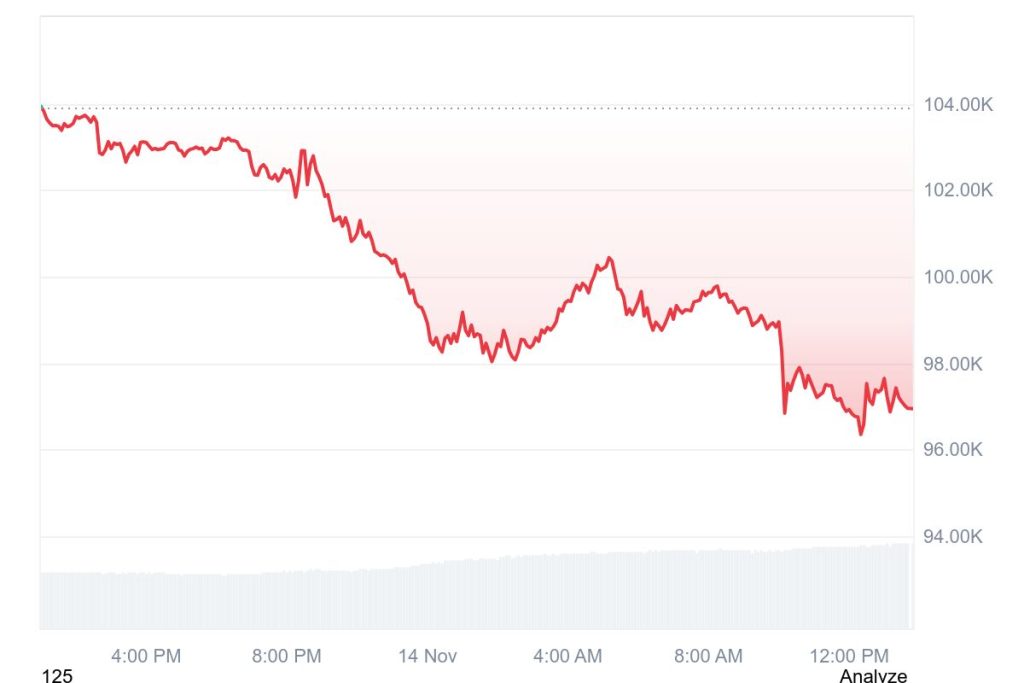

The Thursday outflow coincides with Bitcoin slipping below $100K mark for the first time in 188 days.

Liquidations Hit Over $300M Amid BTC ETFs Selloff

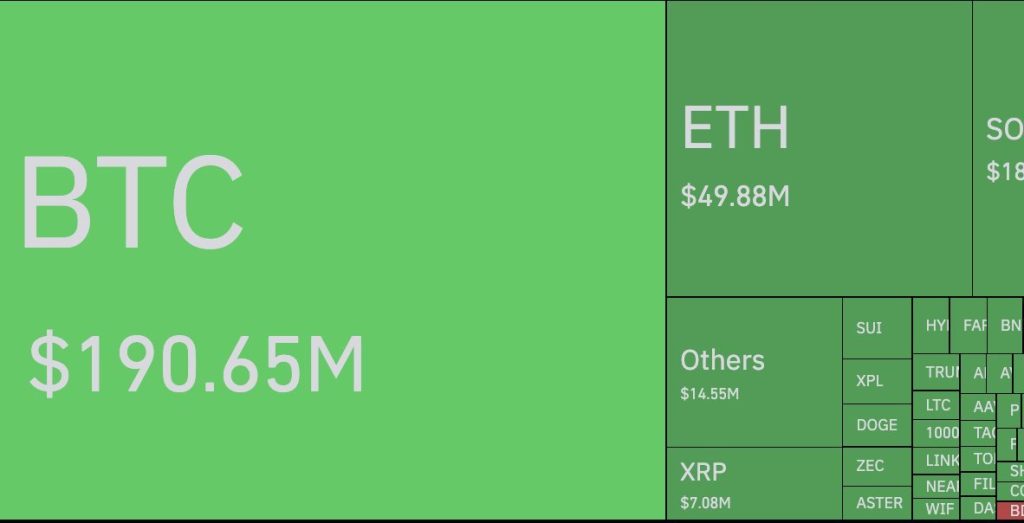

The total amount of liquidations in the cryptocurrency market reached $316 million in leveraged long positions, Per Coinglass data. This prompted several traders to exit their positions.

Liquidations in crypto are primarily tied to long positions that are leveraged bets that anticipate price increases.

Data noted that Bitcoin liquidations amounted to $190.65 million in one hour, while Ethereum liquidations reached $49.88 million.

Meanwhile, Ether ETFs also registered an outflow of $259.72 million, the highest since Oct. 13.

Bitcoin Plunge – Lowest in Over 6 Months

Bitcoin slumped below $100K on Friday, reaching its lowest in over six months. The largest crypto by total market value dropped to $96,682.00 during Asia hours, and is currently trading at $96.94K at press time.

BTC fell 6.2% over the past 24 hours, underperforming the broader crypto market’s 6.15% drop. BTC broke below critical Fibonacci retracement levels of 23.6% at $111,958.

Meanwhile, the Fear & Greed Index (22/100) suggests sentiment remains fragile.

Investors have noted that the slip below $100K “has erased weeks of optimism.”

“Unless institutional buyers step back in, we could be stuck moving sideways… or sliding lower,” wrote one user.

Tim Enneking, managing partner of Psalion, said that several contributing factors have pulled down the BTC price. This includes continued skepticism in many quarters, the ‘bubble’ feeling from all the treasury companies, the predicted end of the bull market in the current four-year cycle and concerns about a macroeconomic slowdown.

Enneking told Forbes that investors need to adjust to just how much the digital asset’s value has climbed all these years.

The post Bitcoin ETFs Bleed $870M in One Day, Marking Second-Largest Outflow on Record appeared first on Cryptonews.