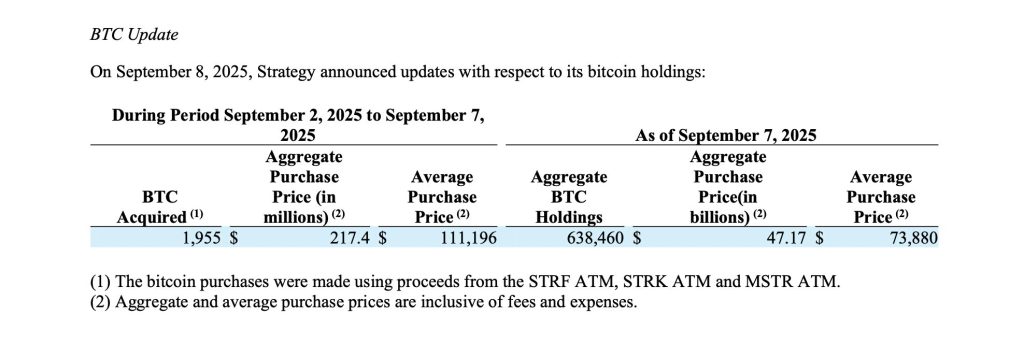

Michael Saylor’s Bitcoin strategy shows no signs of slowing down. On September 8, Saylor’s company Strategy announced that it has acquired an additional 1,955 BTC for approximately $217.4 million.

The latest purchase was made at an average price of $111,196 per bitcoin, highlighting the company’s continued conviction in the long-term value of the asset despite volatility.

Fresh Accumulation Pushes Holdings Higher

With this latest buy, Strategy’s total bitcoin holdings now stand at a staggering 638,460 BTC. The company has spent an aggregate $47.17 billion on these acquisitions, translating to an average purchase price of $73,880 per bitcoin.

At current levels, Strategy is sitting on substantial unrealized gains while maintaining an enviable 25.8% year-to-date yield in 2025.

This accumulation once again shows Saylor’s approach of steadily acquiring bitcoin during both bullish and bearish cycles. The firm has repeatedly emphasized that bitcoin remains its primary treasury reserve asset, and that scaling holdings over time is central to its corporate strategy.

Funding the Bitcoin Purchases

The recent acquisitions were funded through proceeds from various at-the-market (ATM) share offerings, including STRF ATM, STRK ATM, and MSTR ATM.

Between September 2 and September 7, Strategy sold more than 750,000 shares across these vehicles, raising over $217 million in net proceeds. These funds were quickly deployed into bitcoin purchases, reflecting the company’s disciplined treasury allocation process.

The ATM program has become a powerful financing tool for Strategy, allowing it to raise capital efficiently while maintaining momentum in its accumulation strategy.

As of September 7, billions remain available for issuance and future bitcoin purchases, ensuring the company has flexibility to act when market conditions align.

What It Means for Bitcoin’s Next Move

Saylor has long been one of the most vocal proponents of bitcoin, positioning it not only as a hedge against inflation but also as the digital equivalent of gold. With more than 638,000 BTC under management. Strategy is the largest corporate holder of bitcoin by a wide margin.

The timing of the latest buy—above $111,000 per coin—shows confidence that bitcoin’s price has more room to run. Some analysts argue that these bold purchases reflect expectations of new all-time highs in the near future, as institutional demand and scarcity dynamics continue to support the market.

Saylor Joins Bloomberg Billionaires as Net Worth Tops $7.3B

Strategy executive chairman Michael Saylor has joined the ranks of the world’s richest individuals, debuting on the Bloomberg Billionaire Index this week with an estimated net worth of $7.37 billion.

Saylor now holds the 491st spot on the list, after seeing his fortune climb by nearly $1 billion since the start of 2025, a 15.8% increase.

The post Billionaire Michael Saylor Purchases 1,955 BTC for $217.4M – New Highs Coming Soon? appeared first on Cryptonews.