XRP is struggling to reclaim upside momentum after failing to break through the $2.50 resistance zone, raising questions about whether the latest pullback is a buying opportunity or a sign of deeper exhaustion.

XRP trades at $2.25, down slightly over the past 24 hours, with a market cap near $135.4 billion and daily volume above $5.3 billion, still among the highest levels in the altcoin sector.

Amid the price pressure, the market received a major development: the launch of the Canary XRP ETF (NASDAQ: XRPC), the first U.S.-listed product offering spot exposure to XRP. The ETF arrives at a time when investors are actively rotating into assets with real utility, giving the token a stronger institutional profile.

ETF Launch Marks a Turning Point

Canary Capital’s new ETF highlights the market’s growing appetite for institutional-grade exposure to XRP. CEO Steven McClurg said the product is designed to make XRP more accessible to both retail and institutional investors, an important milestone for a network that has long positioned itself as a bridge between traditional finance and blockchain settlement systems.

The XRP Ledger (XRPL) remains one of the few blockchains optimized for fast, low-cost payments rather than speculation. It processes transactions in seconds, consumes minimal energy, and supports real-world applications ranging from cross-border payments to asset tokenization.

Key advantages driving institutional interest:

- High transaction throughput and low fees

- A decade-long operational track record

- Growing enterprise adoption and regulatory clarity

- Practical utility beyond price speculation

These characteristics help explain why XRP continues to attract long-term capital, even as volatility pressures the broader crypto market.

Why XRP Stalled Below $2.50

Despite the ETF tailwind, XRP could not push through the $2.50 resistance, one of the most watched levels on the chart.

Sellers stepped in aggressively near the descending trendline that has capped every rally since early October, forcing the token back into its tightening symmetrical triangle.

On the 4-hour chart, XRP remains below the 20-EMA, signaling short-term weakness. The RSI at 39 shows buyers haven’t stepped in with conviction, while long upper wicks on recent candles indicate consistent profit-taking.

Failure to break the descending trendline has kept the structure in a compression phase, with price hovering just above $2.21, a support level that has repeatedly prevented breakdowns.

XRP Price Forecast: Breakout or Breakdown?

XRP price prediction is neutral as XRP is approaching a decisive moment. The triangle is nearly at its apex, meaning the next move is unlikely to be small. Traders are watching two key scenarios:

- Bearish: A daily close below $2.21 opens the door to $2.07, then $1.92

- Bullish: A close above $2.33 could trigger a rally toward $2.52, then $2.68

For new traders, the cleanest strategy is to wait for confirmation rather than guessing direction. XRP’s next break will likely come with strong volume and swift follow-through.

Bitcoin Hyper: The Next Evolution of BTC on Solana?

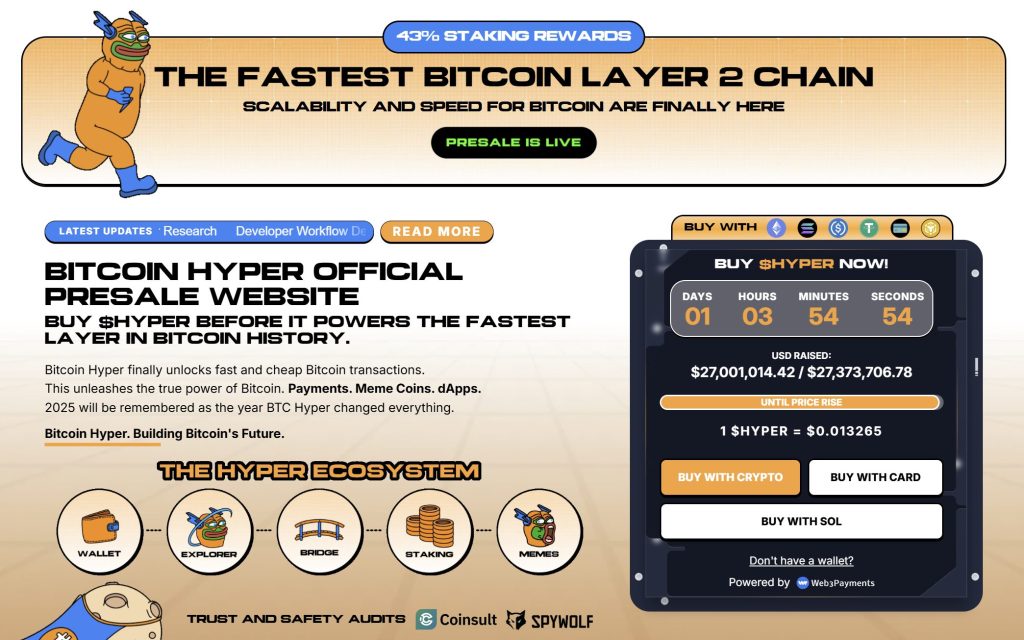

Bitcoin Hyper ($HYPER) is bringing a new phase to the Bitcoin ecosystem. While BTC remains the gold standard for security, Bitcoin Hyper adds what it always lacked: Solana-level speed. The result: lightning-fast, low-cost smart contracts, decentralized apps, and even meme coin creation, all secured by Bitcoin.

Audited by Consult, the project emphasizes trust and scalability as adoption builds. And momentum is already strong. The presale has surpassed $27 million, with tokens priced at just $0.013265 before the next increase.

As Bitcoin activity climbs and demand for efficient BTC-based apps rises, Bitcoin Hyper stands out as the bridge uniting two of crypto’s biggest ecosystems. If Bitcoin built the foundation, Bitcoin Hyper could make it fast, flexible, and fun again.

Click Here to Participate in the Presale

The post XRP Price Prediction: Why XRP Failed to Surge Past $2.50 – Time to Buy? appeared first on Cryptonews.