Royal Bank of Canada., (RY) operates as diversified financial service company worldwide. It operates through personal finance, commercial banking, wealth management & Insurance segments. It comes under Financial services sector & trades as “RY” ticker at NYSE. RY favors rally within April-2025 sequence as showing in (1) discussed in last article. It expects further upside in 5 of (1) impulse into $150.86 – $153.23 area, while dips remain above 10.13.2025 low to end (1). We like to buy later in (2) pullback in 3, 7 or 11 swings pullback at extreme area.

RY – Elliott Wave Latest Weekly View:

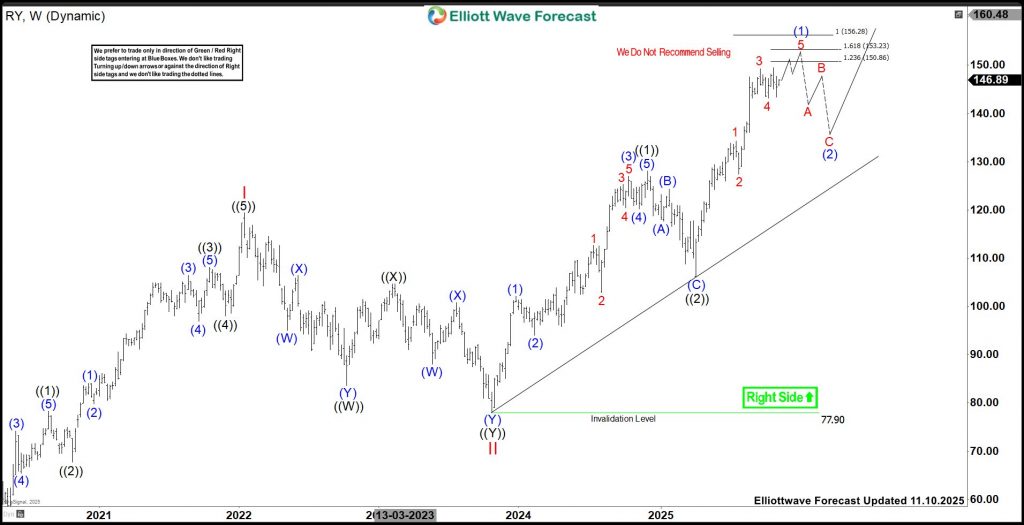

Since March-2020 low as (II), it started rally in (III) in weekly. It placed I of (III) at $119.41 high in January-2022 & II at $77.90 in October-2023 low. Within I, it ended ((1)) at $78.31 high, ((2)) at $67.78 low, ((3)) at $108.09 high, ((4)) at $98.00 low & finally ((5)) at $119.41 high. Within II, it ended ((W)) at $83.63 low, ((X)) at $104.72 high & ((Y)) at $77.90 low as $0.618 Fibonacci retracement of I. Above II low, it placed ((1)) of III at $128.05 high in December-2024 & ((2)) at $106.10 low in April-2025. Within ((1)) of III, it ended (1) at $102.07 high, (2) at $93.97 low, (3) at $126.96 high, (4) at $120.26 low & (5) at $128.05 high.

RY – Elliott Wave View From 9.22.2025:

Above ((2)) low, it favors rally in (1) & can extend towards $150.86 to $156.28 area to finish it. Within (1), it ended 1 at $134.26 high, 2 at $127.38 low, 3 at $149.26 high & 4 at $143.13 low of 10.13.2025. Currently, it favors higher in 5 of (1) as it already broke to above 3 high. It expects two more swings in 5, which confirm above 149.44 high to extend into $150.86 – $153.26 area to finish (1). Do not like to chase the small upside as it has minimum swings in placed. We like to buy the next pullback in (2) in 3, 7 or 11 swings, while dips hold the up-trending trendline. RY is not the part of regular service at EWF. But we provide time to time updates on instrument under Free Articles section. Elliottwave Forecast updates 1-hour charts four times a day & 4-hour charts once a day for all our 78 instruments. We do a daily live session, where we guide our clients on the right side of the market. In addition, we have a chat room where our moderators will help you with any questions you have about what is happening in the market at the moment. You can try our services for 14 days at $0.99. Also, you can check out the Educational section to learn Elliott wave theory & its application through different packages available & 1-1 coaching for doubts.

The post RY (Royal Bank of Canada) Favors Final Push Before Pullback appeared first on Elliott Wave Forecast.