American Bitcoin and Strategy collectively purchased over $205 million in Bitcoin in the past 48 hours, contradicting Coinbase’s warnings that corporate treasuries have largely abandoned the market during October’s downturn.

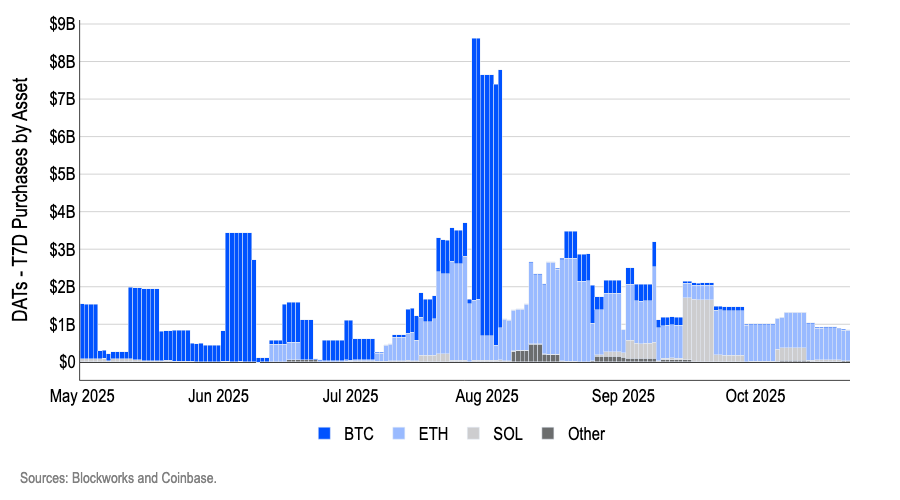

Coinbase’s Global Head of Investment Research, David Duong, recently warned that digital asset treasury companies have largely ghosted the market since October 10, with Bitcoin purchases falling to near year-to-date lows over the past two weeks.

“BTC digital asset treasury companies (DATs) have largely ghosted the post-Oct 10 drawdown and are yet to re-engage,” he said.

Major Treasury Firms Continue Aggressive Accumulation

American Bitcoin acquired approximately 1,414 Bitcoin between September and October 24, increasing its strategic reserve to 3,865 Bitcoin held in custody or pledged for miner purchases under agreements with BITMAIN.

The Miami-based company, now a majority-owned subsidiary of Hut 8 Corp, operates as a Bitcoin accumulation platform integrating scaled self-mining operations with disciplined purchase strategies.

The firm introduced a new transparency metric, Satoshis Per Share, which represents the amount of Bitcoin attributable to each outstanding share of common stock.

As of October 24, the company reported 418 satoshis per share, marking a 52% increase since September 1, providing shareholders with insight into their indirect Bitcoin ownership through equity holdings.

“What sets American Bitcoin apart from most traditional Bitcoin treasury vehicles is our integrated mining operations,” said Asher Genoot, Executive Chairman of American Bitcoin.

“By producing Bitcoin directly, we can reduce our average cost per Bitcoin to drive a cost advantage over vehicles that buy exclusively on the open market,” he said.

Treasury Activity Accelerates Across Global Markets

Strategy, the business intelligence firm led by Bitcoin advocate Michael Saylor, acquired an additional 390 BTC between October 20 and October 26, spending $43.4 million at an average price of $111,117 per Bitcoin.

The purchase brings the company’s total holdings to 640,808 BTC, acquired at an aggregate price of $47.44 billion with an average cost of $74,032 per Bitcoin, inclusive of fees.

Beyond U.S. markets, South Korea’s Bitplanet announced plans to acquire 50 BTC worth approximately $5.8 million after receiving shareholder approval.

At the same time, Hong Kong-based Prenetics Global also raised $150 million through a convertible note offering backed by Galaxy Digital to establish its Bitcoin treasury strategy.

Bitplanet CEO Aaron Gerovich stated that “accumulating Bitcoin represents a strategic hedge against global fiat debasement,” saying they are pioneering corporate adoption in Asia.

Strategy’s ATM programs collectively provide access to more than $46 billion in potential issuance capacity, giving the firm flexibility to continue adding Bitcoin as market conditions evolve.

Saylor has repeatedly described Bitcoin as “digital property” and “the ultimate treasury reserve asset,” maintaining unwavering conviction despite recent market volatility that saw prices briefly dip below $107,000 earlier this month.

Market Fragility Concerns

Notably, Coinbase’s analysis reveals concerning concentration in the corporate treasury market, with Ethereum purchases driven almost entirely by a single entity, Bitmine.

Aggregate seven-day Ethereum treasury purchases remain positive, but attribution shows BMNR driving the majority of net buying with smaller contributions from other funds, raising concerns that apparent corporate demand could fade if this single buyer slows or pauses.

“DAT buying hasn’t shown up for BTC and is narrowly concentrated for ETH, which highlights some caution from large players post leverage washout, even at current ‘support’ levels,” Duong stated in his analysis.

“We think this warrants more cautious positioning in the short term, because the market appears more fragile when the biggest discretionary balance sheets are sidelined.“

This detection follows a $19 billion wipeout of leveraged positions earlier this month that prompted widespread caution among treasury companies that typically provide significant buying support during market downturns.

Bitcoin recovered roughly 3% since then, especially after softer-than-expected U.S. inflation data reinforced expectations for potential Federal Reserve rate cuts in December.

Additionally, Coinbase Research also warned last month that the corporate crypto treasury movement has reached a critical turning point, transitioning from an era of guaranteed premiums to what it calls a “player-versus-player” competitive phase.

The scarcity premium benefiting early adopters like Strategy has dissipated, forcing companies to differentiate themselves through strategic positioning rather than merely accumulating Bitcoin.

Strategy abandoned its self-imposed 2.5x market-to-net-asset-value threshold for stock sales after funding pressures mounted, while Nasdaq tightened supervision requirements for digital asset treasuries, demanding shareholder approval for certain transactions.

The post Coinbase Says Bitcoin Treasuries Are ‘Ghosting’, But Two Firms Just Bought $205M appeared first on Cryptonews.

…

…  (@Dav1dDuong)

(@Dav1dDuong)  South Korean public company Bitplanet launches 10,000

South Korean public company Bitplanet launches 10,000  Crypto treasury competition drives strategic innovation and sustained buying pressure as companies move beyond simple accumulation strategies.

Crypto treasury competition drives strategic innovation and sustained buying pressure as companies move beyond simple accumulation strategies.