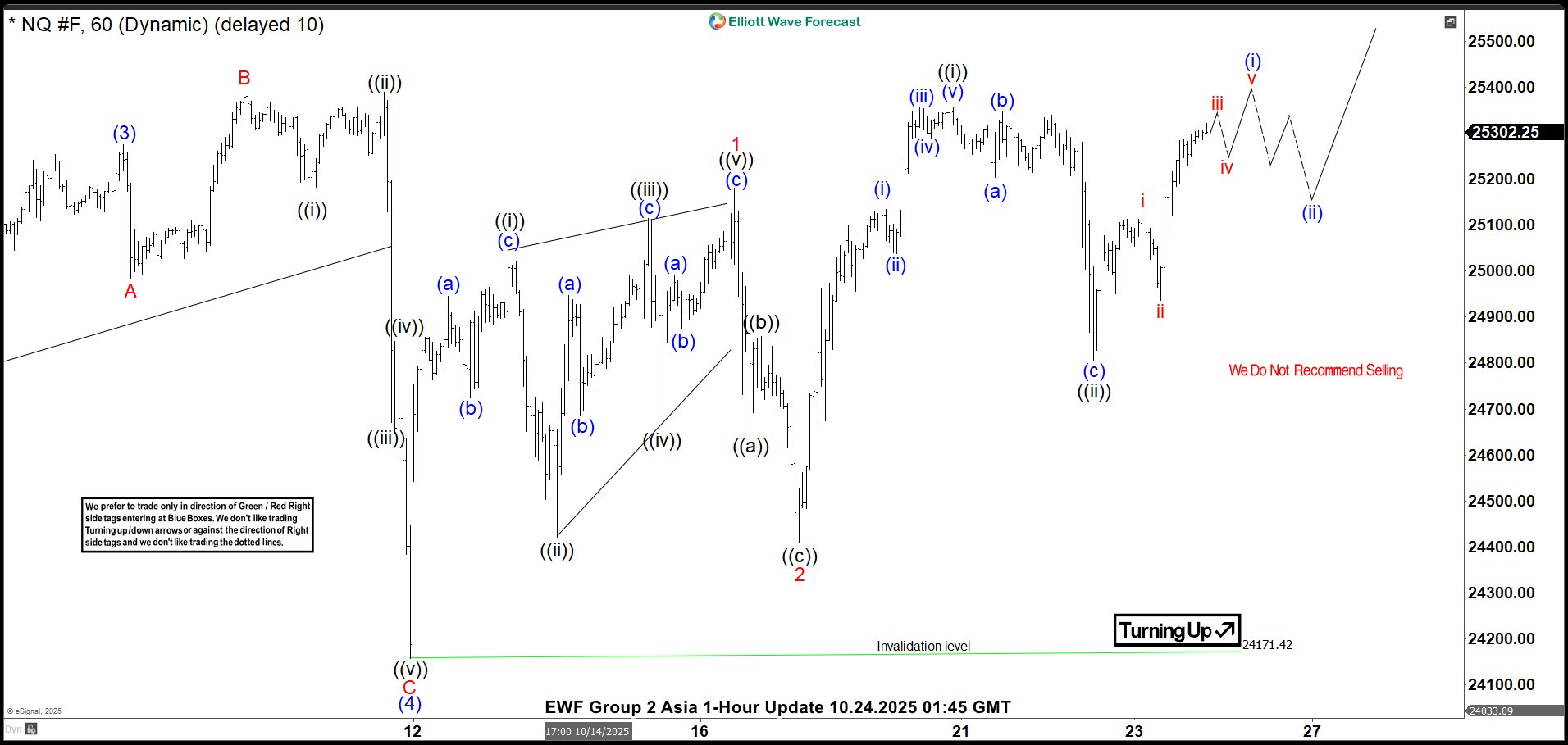

Nasdaq Futures (NQ) advances steadily toward completing the cycle that originated at the April 7, 2025 low. The index targets a fresh all-time high. This rally develops as a textbook impulsive structure. Wave (3) culminated at 25,275. Wave (4) then corrected lower and finished at 24,166.26. The 1-hour chart captures this progression clearly. The internal structure of wave (4) took the form of an expanded flat. Wave A ended at 24,984.75. The Index then rallied in Wave B to 25,394. Wave C completed the pattern with a decline to 24,166.26. Wave (5) now drives the index higher. From the wave (4) low, wave 1 rose to 25,179.5 and formed a leading diagonal. Wave 2 pulled back to 24,410. The advance then nested with wave ((i)) peaking at 25,368 and wave ((ii)) finding support at 24,804.75. This nesting confirms the underlying bullish trend. Provided prices hold above 24,166.26, any near-term dip should attract buyers at the 3, 7, or 11 swing levels, aligning with structural support zones. Upside momentum remains intact. The minimum target extends from the October 21, 2025 high. An inverse Fibonacci retracement of 123.6% to 161.8% yields a range of 25,490 to 25,701, consistent with classic wave extensions.

Nasdaq Futures (NQ) Latest 1-Hour Elliott Wave Chart From 10.24.2025

NQ Elliott Wave Video:

The post Nasdaq Futures (NQ) Targeting Wave (5) Upside Within Cycle Wave from April 2025 Low appeared first on Elliott Wave Forecast.