Bitcoin ($BTCUSD) is trading near $109,373, down 1.78% over the last 24 hours, with a market cap of $2.17 trillion. While the near-term outlook remains under pressure, the bigger story is unfolding in corporate investment. Google has agreed to backstop $1.4 billion of lease obligations for Fluidstack in exchange for a 5.4% stake in Cipher Mining, a Nasdaq-listed Bitcoin miner.

The agreement is part of a $3 billion, 10-year deal under which Cipher will provide 168 megawatts of high-performance computing (HPC) power at its Barber Lake facility in Texas. With room for expansion to 500 MW, the site positions Cipher as a key player in the crossover between Bitcoin mining and artificial intelligence.

This marks Google’s second mining-linked investment in just two months, following its 14% stake in TeraWulf in August. Analysts say the move signals Wall Street’s growing appetite for companies that integrate crypto mining with AI-driven infrastructure.

Key Deal Highlights:

- $3B in contract value over 10 years, with potential to rise to $7B.

- Google to acquire ~24 million Cipher shares (5.4% stake).

- Barber Lake site: 168 MW initial capacity, expandable to 500 MW.

- Cipher’s pipeline includes ~2.4 GW of HPC projects.

Crypto Miners Shift Into AI Infrastructure

Cipher CEO Tyler Page described the deal as “transformative,” highlighting demand for compute power from AI-focused companies. Fluidstack President César Maklary echoed this, saying the partnership ensures the infrastructure needed for frontier AI firms.

The deal reflects a broader industry pivot. CleanSpark recently secured $100M to expand its AI infrastructure, while Hive Digital announced a $100M HPC expansion after reporting record quarterly revenue. Data from The Miner Mag shows Bitcoin mining stocks have outperformed Bitcoin itself in recent weeks, largely thanks to investor enthusiasm for AI pivots.

Industry analysts argue that miners diversifying into HPC and AI are being rewarded with stronger valuations, as the shift offers more stable revenues compared to volatile Bitcoin mining alone.

Bitcoin (BTC/USD) Technical Outlook

While corporate capital flows are reshaping the industry, Bitcoin’s price action remains under short-term pressure. On the 4-hour chart, Bitcoin trades below both the 50- and 100-SMA near $113,700, signaling continued bearish control.

A descending triangle has formed, with lower highs pressing toward support at $107,300. Candlestick formations reinforce the bearish tone: a shooting star at $116,000 was followed by a “three black crows” sequence.

The RSI sits at 31, close to oversold, but without bullish divergence, suggesting momentum still favors sellers.

- Key support levels: $107,300, $105,200, and $102,800.

- Resistance levels: $111,100 and $113,700.

- Trade setup: A short position near $109,500–$110,000 with a stop above $112,500 targets $107,300 initially.

For new traders, think of Bitcoin’s chart like a room: resistance near $113K acts as the “ceiling,” while $107K serves as the “floor.” If the floor gives way, lower levels quickly come into focus.

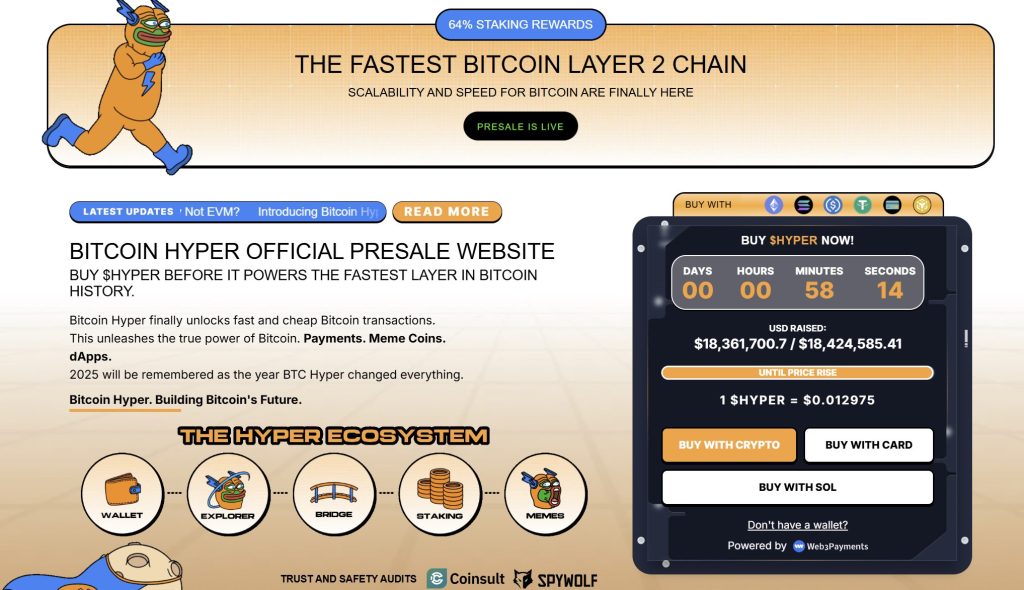

Presale Bitcoin Hyper ($HYPER) Combines BTC Security With Solana Speed

Bitcoin Hyper ($HYPER) is positioning itself as the first Bitcoin-native Layer 2 powered by the Solana Virtual Machine (SVM). Its goal is to expand the BTC ecosystem by enabling lightning-fast, low-cost smart contracts, decentralized apps, and even meme coin creation.

By combining BTC’s unmatched security with Solana’s high-performance framework, the project opens the door to entirely new use cases, including seamless BTC bridging and scalable dApp development.

The team has put strong emphasis on trust and scalability, with the project audited by Consult to give investors confidence in its foundations.

Momentum is building quickly. The presale has already crossed $18.3 million, leaving only a limited allocation still available. At today’s stage, HYPER tokens are priced at just $0.012975—but that figure will increase as the presale progresses.

You can buy HYPER tokens on the official Bitcoin Hyper website using crypto or a bank card.

Click Here to Participate in the Presale

The post Bitcoin Price Prediction: Google Buys Into Bitcoin Mining in $3 Billion Deal – Wall Street is Coming Fast appeared first on Cryptonews.