Key Takeaways:

- Aster token surged by over 2,200% within days of launch, climbing from $0.084 to nearly $2 by Sept. 21.

- The project emerged after the merger of Astherus and APX Finance and quickly drew attention due to backing from Binance founder CZ.

- On-chain data shows over 93% of Aster token supply is concentrated in five wallets, raising concerns of manipulation and insider activity.

- Community opinion is divided: some call it the “best marketing move”, while others warn it could be another pump with little product behind it.

Aster (ASTER) is a new project that some are already calling a key rival to Hyperliquid (HYPE). The platform is informally backed by Binance and aims to capture part of the derivatives market. But what could go wrong?

According to CoinMarketCap, on Sept. 17, the Aster token traded at around $0.08439, its lowest point on the first day of trading. By Sept. 21 it climbed to $1.97, setting a new all-time high (ATH). That is a 2,235% surge in just a few days, which many in the crypto market described as one of the first strong signals of an upcoming “altcoin season.”

The Aster project began in late 2024 after the merger of Astherus and APX Finance. It only started to gain attention with the launch of the Aster token. The token’s explosive growth coincided with rare public support from Binance founder Changpeng Zhao (CZ). The crypto community has not seen CZ openly back a project in this way for a long time. The question is: why Aster?

Binance Does Not Want to Lose to Hyperliquid

Hyperliquid has become one of the most successful projects in the crypto industry in 2025. Launched in this winter, it quickly turned into one of the highest-earning platforms outside of stablecoins. Over the past 30 days, the platform generated nearly $91 million in revenue, according to DeFiLlama. Today it is one of the leading derivatives platforms in decentralized finance (DeFi) and in crypto overall.

The project succeeded because it addressed key weaknesses of decentralized exchanges (DEXs) while also improving on the flaws of centralized exchanges (CEXs). Hyperliquid is a hybrid of both models but still follows the principles of decentralization.

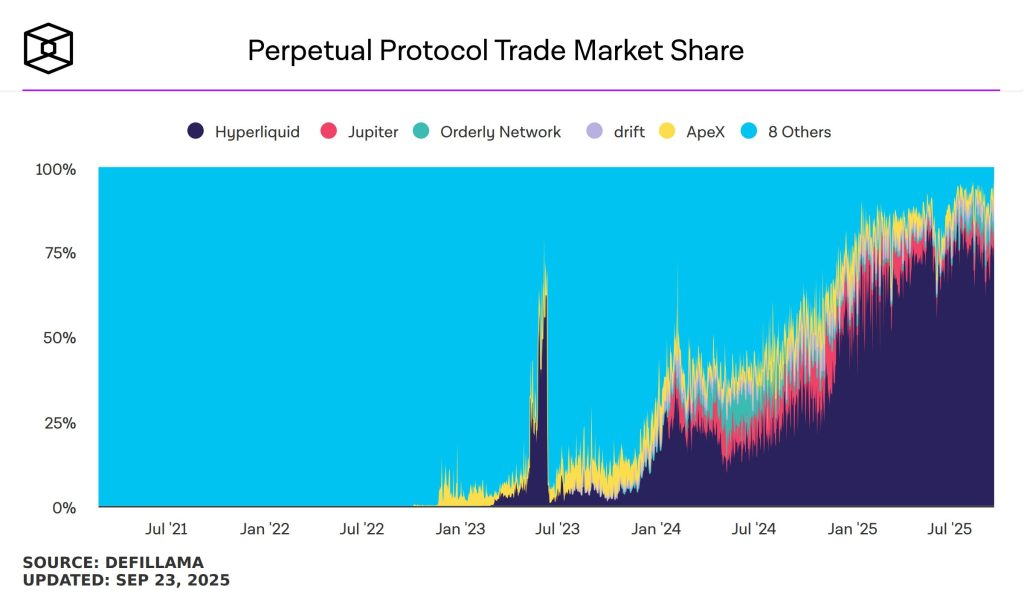

The platform solved problems such as low liquidity, high gas fees, and mandatory KYC. At the moment, Hyperliquid holds 80% of the perpetual protocols market. This is a threat not only to DEXs but also to CEXs. Binance founder Changpeng Zhao seems to understand this and has been actively promoting the Aster token.

The context of Hyperliquid’s success is important for Aster. Centralized exchanges are paying close attention because the competition is real. Whoever manages to dominate the decentralized derivatives market first will gain the upper hand. This is what Binance is trying to achieve by informally backing the Aster. CZ has been consistently posting about the project on his personal X account. Officially, he does not represent Binance in this case, but the community understands the implications.

Aster is also a decentralized derivatives platform, similar to Hyperliquid. It has its own stablecoin, USDF, which operates on the BNB Chain.

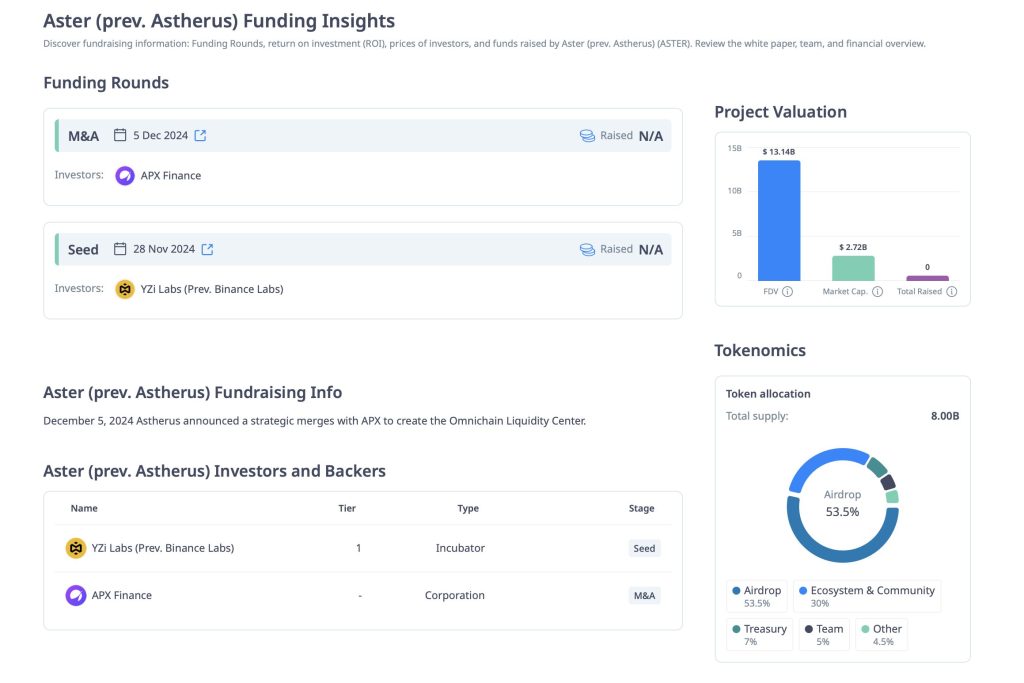

The ties to Binance can be found in other areas, too. One of Aster’s sponsors is YZi Labs, formerly known as Binance Labs. How much the Aster token received is not publicly available, but it is known that YZi Labs participated in the project’s funding round on Nov. 28, 2024. Notably, this happened before Hyperliquid’s rise.

A Good Story Spoiled by Aster Token Manipulation

The backing from CZ created significant hype around the Aster token. The project’s narrative, which combines a decentralized exchange model with a native stablecoin, looked promising at first. The price surged by about 2,250% in the week after launch. Most of the action took place over the weekend of Sept. 20-21. On Sunday, the token traded close to $2, even though it had started below $0.09.

At the same time, reports of insider trading began to surface. Some analysts even described it as one of the largest cases of manipulation in the crypto market this year. The Aster token has been criticized for its $2.78 billion market cap, which does not reflect the project’s fundamentals. The product is not live, trading volumes remain low, and most of the supply is concentrated in just a handful of addresses. This concentration gives large holders control over the price and leaves the market with no way to short the token.

On-chain analysts have found that the majority of the supply is controlled by a few wallets managed through SafeProxy multisigs. The five largest addresses hold more than 93% of the supply, and one wallet alone controls nearly half of all tokens. A main vault wallet recently moved over 160 million tokens, which fueled further suspicion of manipulation. Meanwhile, the market has seen large whale transactions. Some traders are using leverage to buy, others are cashing out, and new wallets continue to accumulate.

Insiders have also been spotted in the activity around the Aster token. One of them, known as Mr. Beat, purchased nearly $150,000 worth of the token.

Divided Opinions

This is not the first time Binance has been linked to insider trading. Manipulation has become easier with programs like Binance Alpha, which is used to launch new tokens. A similar case happened recently with MYX Finance (MYX), where insiders were spotted during a sharp price rally.

While part of the crypto community has been highly skeptical of the Aster token and advised traders to avoid it, others believe the project still has potential.

Some have even called it the “best marketing move”, while others see it as just another pump designed to extract money from retail investors. For now, the future of the Aster token remains uncertain. What is clear is that the project has quickly become one of the most talked-about launches of 2025, and whether it can deliver on its promises will determine whether the hype was justified or not.

The post How Binance Drove Aster Token Up 2000%: HYPE War & Insiders appeared first on Cryptonews.

BNB (@cz_binance)

BNB (@cz_binance)

△ (@AlexMasonCrypto)

△ (@AlexMasonCrypto)