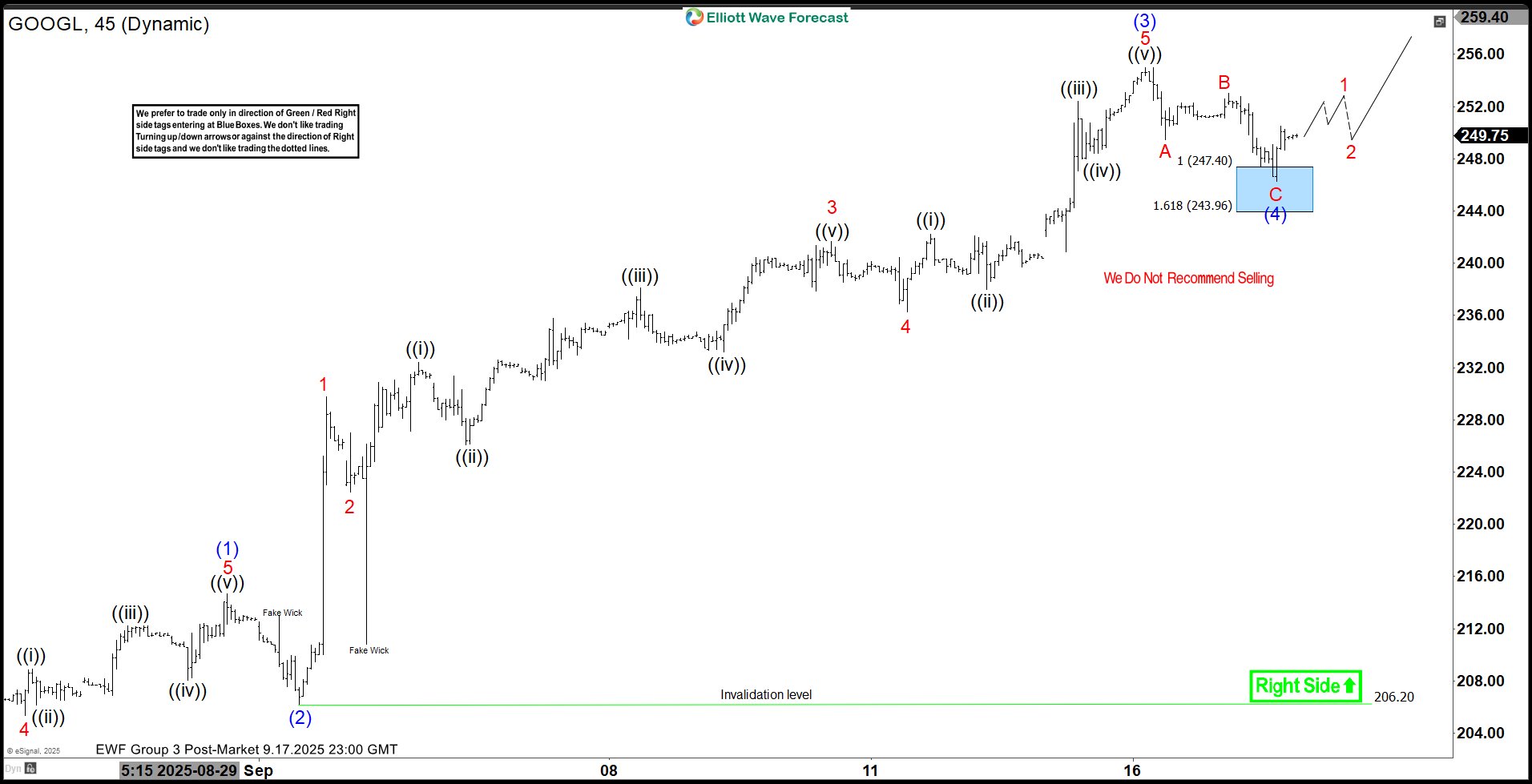

The short-term Elliott Wave analysis for Alphabet Inc. (GOOGL) indicates that the cycle starting from the August 20, 2025 low is unfolding as a five-wave impulse. From that low, wave (1) concluded at $214.65, followed by a pullback in wave (2) that ended at $206.19. The subsequent wave (3) advanced in a five-wave impulse structure on a smaller scale. From wave (2), wave 1 peaked at $229.75, and wave 2 retraced to $222.44. The stock then surged in wave 3 to $241.66, with wave 4 correcting to $236.25. The final leg, wave 5, reached $255, completing wave (3) on a higher degree. A pullback in wave (4) likely concluded at $246.28, structured as a zigzag. From wave (3), wave A declined to $249.47, wave B rallied to $253, and wave C fell to $246.28, finalizing wave (4). The stock has since resumed its upward trajectory in wave (5). However, it must break above the wave (3) high of $255 to eliminate the possibility of a double correction. In the near term, as long as the pivot at $206.19 holds, any pullback should find support in a 3, 7, or 11-swing sequence, setting the stage for further upside. Google (GOOGL) – 45 Minute Elliott Wave Technical Chart:

GOOGL – Elliott Wave Technical Video:

The post Elliott Wave Analysis: Google (GOOGL) Targets Wave (5) at $257 appeared first on Elliott Wave Forecast.