Analysts at Derive, a crypto options exchange, anticipate Bitcoin reaching $140,000 by year-end, with Ethereum potentially climbing to $6,000, driven by three major bullish factors creating what could be the strongest crypto bull run in recent years.

In a comprehensive market analysis presented by Sean Dawson, Derive’s head of research, he maintains the bull market is already at play.

He urged investors to prepare “for an intense period of dramatic price movements, historic gains, and a market poised to break new all-time records.”

Why Trump’s Macro Conflicts of Interest Are Crypto’s Biggest Catalyst

Dawson identifies declining interest rates as a primary catalyst for the anticipated cryptocurrency rally.

He noted that Trump’s controversial dismissal of Fed Governor Lisa Cook signals the administration’s intention to appoint allies committed to rate reductions.

The U.S. Producer Price Index (PPI) data released on Wednesday now show a 0.1% decline in August, marking the first monthly decrease in four months after a revised 0.7% July increase.

This has positioned the Federal Reserve for a rate cut in the coming week.

Reduced interest rates typically see investors gravitate toward higher-risk investments as bond yields become less attractive.

A second key driver behind Derive’s elevated crypto price projections is the Trump Administration’s alignment with the digital asset sector, given the Trump family’s substantial crypto investments.

Notable examples include Donald Trump Jr.’s eight-figure Polymarket investment, the family’s $5 billion stake in WLFI, and the $TRUMP token phenomenon.

The president has explicitly branded himself as “the crypto president”, providing the clearest possible endorsement for the industry.

Derive researchers recalled that regulatory uncertainty dominated crypto concerns over the past four years.

“Now we have an administration with clear conflicts of interest actively promoting bullish sentiment.”

The third catalyst driving the cryptocurrency bull run, according to Dawson, is the growing Digital Asset Treasuries (DATs) such as MicroStrategy for Bitcoin and Bitmine for Ethereum, which have evolved into this cycle’s leverage mechanisms.

Over the past four months alone, DATs have acquired nearly 4% of Ethereum’s total supply and show no signs of slowing.

These converging bullish forces have led Derive analysts to establish ambitious targets for major cryptocurrency assets going into Q4 2025.

$140K Bitcoin, $6K Ethereum, and Full-blown Altseason by December?

Under optimal conditions, Derive analysts project Bitcoin could surge to $140,000 by year-end, with $200,000 as a conservative cycle peak and $250,000 possible if institutional capital continues flowing.

In a less favorable scenario featuring fewer rate cuts and escalating trade tensions, Bitcoin would likely retest $90,000 levels.

For Ethereum, analysts project $6,000 as the most probable upside target by year-end, especially if DAT demand persists and the Federal Reserve maintains rate cuts.

“An advance toward $8,000 would likely signal the cycle top, though that scenario appears more realistic by mid-2026.”

On the downside, intensified trade conflicts or tariffs could force Ethereum to retest $3,000.

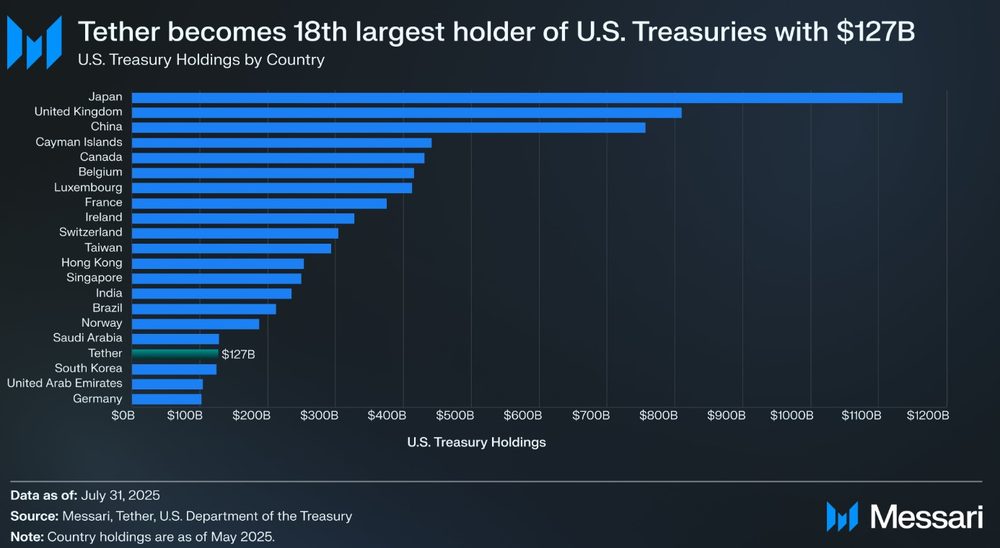

Dawson also highlighted stablecoins as potential bull run beneficiaries, particularly following the GENIUS Act’s passage.

The United States is establishing conditions for USD stablecoins to become significant holders of government debt.

The current stablecoin market totals $280 billion, with Tether leading at $127 billion.

Recent Treasury Secretary Scott Bessent’s projections anticipate stablecoin growth exceeding 600% by 2028, reaching $2 trillion.

Beyond Bitcoin, Ethereum, and stablecoins, analysts expect an altcoin season that could create hedging and speculative opportunities across diverse token categories.

“Secondary majors like Solana and XRP will lead the way, but cycle completion could bring substantial options volume for tokens like HYPE, UNI, and AAVE,” Dawson explained.

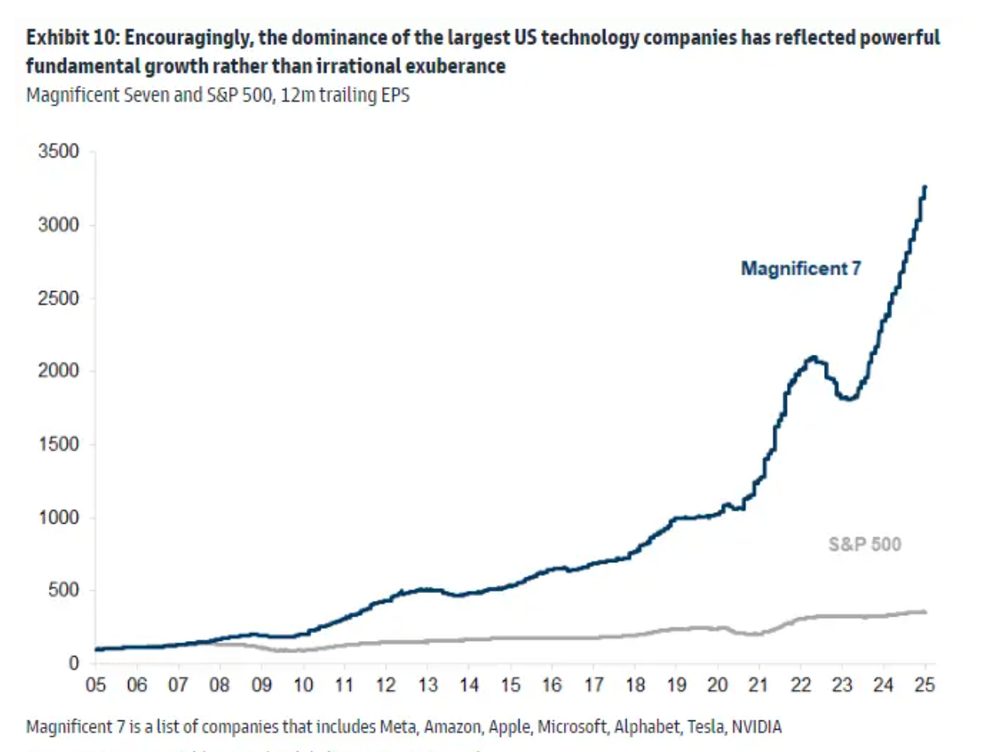

However, Derive analysts identify a major risk that could derail the cryptocurrency rally, which is a broader market correction on the heels of the AI revolution.

Data reveals that “Magnificent 7” returns (Apple, Amazon, Alphabet, Microsoft, Meta, Nvidia, Tesla) have driven S&P 500 performance, showing how recent market strength concentrates in select equities.

These technology giants are heavily investing in AI, spending $155 billion on AI development this year alone.

The outrageous spending has created a market bubble concerns, with even OpenAI’s Sam Altman expressing cautious agreement.

Should markets begin questioning these investments’ sustainability, the resulting correction would likely spread to cryptocurrency markets.

The post Analysts Eye $140K Bitcoin and $6K Ethereum by Year-End on Macro Trump Catalysts appeared first on Cryptonews.

U.S. wholesale inflation unexpectedly falling 0.1% in August, along with a softer labor market, has increased forecasts for a September rate cut. Bitcoin has climbed above $113k.

U.S. wholesale inflation unexpectedly falling 0.1% in August, along with a softer labor market, has increased forecasts for a September rate cut. Bitcoin has climbed above $113k.