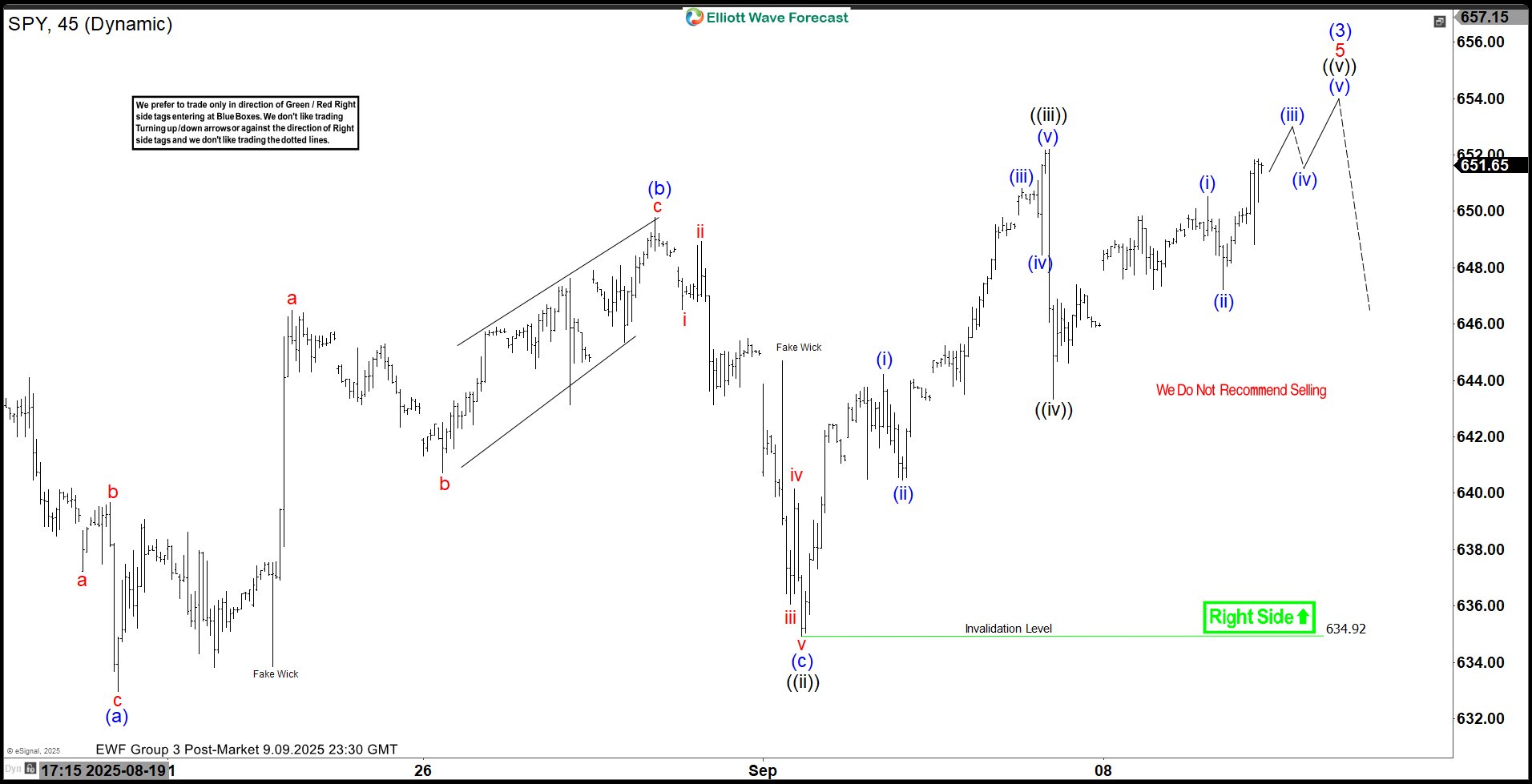

The short-term Elliott Wave outlook for the S&P 500 ETF (SPY) highlights a cycle starting from the August 1 low. This cycle is unfolding as a diagonal and nears completion. The initial wave ((i)) peaked at 647.04 after the August 1 low. A pullback in wave ((ii)) dropped to 634.92, forming a running flat Elliott Wave. From the wave ((i)) high, wave (a) fell to 632.95. Wave (b) then rose to 649.79. Wave (c) declined to 634.92, finishing wave ((ii)) at a higher degree. The ETF climbed further in wave ((iii)) to 652.21. A pullback in wave ((iv)) reached 643.33. We expect wave ((v)) to push higher, completing wave 5 of (3). After this, a larger degree wave (4) pullback should occur. A final leg, wave (5), will likely follow to end the cycle from the April 2025 low. In the near term, the pivot at 634.92 must hold. If it does, dips should find support at the 3, 7, or 11 swing levels. This support will pave the way for more upside. Traders can watch these levels closely for confirmation of the ongoing trend. The outlook suggests a structured advance with clear targets ahead. S&P 500 ETF (SPY) – 45 Minute Elliott Wave Technical Chart:

SPY – Elliott Wave Technical Video:

The post SPY Elliott Wave Outlook: Wave (3) Nearing Termination appeared first on Elliott Wave Forecast.