Bitcoin staged a sharp spike to $116,250, gaining more than 3% in 24 hours and briefly lifting sentiment across the crypto market. The move comes despite a cautious backdrop from traditional markets, where traders continue to weigh the Federal Reserve’s rate outlook.

The rally highlights crypto’s resilience and ability to attract capital flows even in moments of macro uncertainty.

Powell’s Jackson Hole Message

At Jackson Hole, Fed Chair Jerome Powell acknowledged progress in cooling inflation but avoided committing to an aggressive rate-cut path. He signaled that a 25 bps cut in September is “highly likely”, the clearest sign yet of near-term easing.

However, Powell cautioned against expecting a rapid series of cuts. He stressed the Fed’s “data-dependent” stance, pointing to risks from tariff-driven inflation and keeping the door open to holding rates higher for longer if needed.

The mixed tone spilled into markets. U.S. equities trimmed early gains, and crypto mirrored the volatility, leaving traders caught between optimism over easing inflation and concern that liquidity could remain tight through year-end.

FedWatch Tool Reaction

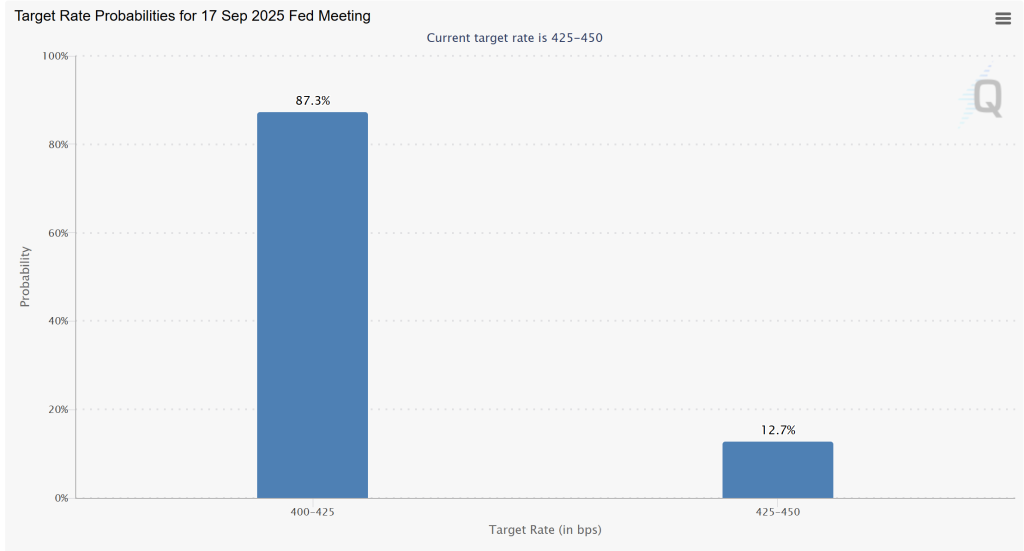

The CME FedWatch Tool now shows an 87.3% probability of a cut to 400–425 bps at the September 17 meeting, with only 12.7% odds of holding steady at 425–450 bps. Markets largely took this as confirmation of easing, though Powell’s warning kept risk sentiment restrained.

Crypto Market Reaction

Despite Powell’s restraint, major digital assets held ground. Bitcoin trades at $116,269, up 3.28% in the past 24 hours, with a market cap of $2.31 trillion. Ethereum gained 12.3% this week to $4,749, showing renewed momentum ahead of its network upgrades. XRP climbed to $3.04, while Solana surged 7.48% in the last day to $194.80, reflecting strong demand for high-performance chains.

The resilience underscores how crypto is now tightly linked to global monetary policy shifts. Investors are weighing whether Powell’s hesitation delays fresh capital inflows, or whether slowing inflation creates room for a medium-term rally across digital assets.

Bitcoin Technical Outlook

Technically, Bitcoin faces a battle at the $116,500–$118,000 zone, where sellers capped recent rallies. A breakout above $118,500 could set the stage for a run toward $123,000 and eventually the psychological $130,000 barrier.

On the downside, $112,000 is the key support level to watch. A close below this threshold risks deeper correction toward $108,000.

- 50-day SMA: trending upward, supporting bullish momentum.

- RSI (Daily): sits near 54, leaving room for further gains.

- MACD: signals weakening bearish pressure, but volume confirmation is needed for a breakout.

Broader Implications

Crypto investors are increasingly aligning their strategies with Fed communication. While Powell’s speech didn’t commit to near-term cuts, the acknowledgment of cooling inflation gives Bitcoin and Ethereum room to consolidate above key support levels. If economic data in Q4 confirms slowing inflation and softer growth, crypto could benefit as capital seeks alternative hedges.

For now, the market remains data-driven: stronger U.S. inflation readings would pressure Bitcoin below $112K, while softer prints may open the path back toward $130K.

Summary: Powell’s cautious tone at Jackson Hole has tempered hopes of quick rate cuts, but crypto markets remain resilient. Bitcoin’s outlook hinges on defending $112K support and breaking past $118.5K resistance to confirm a push toward $130K.

New Presale Bitcoin Hyper ($HYPER) Combines Bitcoin Security With Solana Speed

Bitcoin Hyper ($HYPER) is positioning itself as the first Bitcoin-native Layer 2 powered by the Solana Virtual Machine (SVM). Its goal is to expand the Bitcoin ecosystem by enabling lightning-fast, low-cost smart contracts, decentralized apps, and even meme coin creation.

By combining Bitcoin’s unmatched security with Solana’s high-performance framework, the project opens the door to entirely new use cases, including seamless BTC bridging and scalable dApp development.

The team has put strong emphasis on trust and scalability, with the project audited by Consult to give investors confidence in its foundations.

Momentum is building quickly. The presale has already crossed $11.3 million, leaving only a limited allocation still available. At today’s stage, HYPER tokens are priced at just $0.012775—but that figure will increase as the presale progresses.

You can buy HYPER tokens on the official Bitcoin Hyper website using crypto or a bank card.

Click Here to Participate in the Presale

The post Bitcoin Price Prediction: Sudden $116K Spike Meets Powell’s Jackson Hole Caution appeared first on Cryptonews.